Session Speakers

Fatima Abbas

Haliwa Saponi

Director | Office of Tribal and Native Affairs | U.S. Department of the Treasury

John Balbach

Director of Impact Investments | MacArthur Foundation

Amber Bell

Executive Vice President, Chief Strategy Officer | Opportunity Finance Network

Pamela Boivin

Menominee Indian Tribe of Wisconsin

CCIA Program Manager | Native CDFI Network

Dave Cade

Housing Director | Dry Creek Rancheria Band of Pomo Indians

Kimberley Carr

Affordable Lending Manager | Mission and Community Engagement | Freddie Mac

Chrystel Cornelius

Ojibwe; Oneida

CEO & President | Oweesta

Dante Desiderio

Sappony

Chief Financial and Economic Strategist | Native Americans in Philanthropy

Caitlin Duffy

First Vice President of Philanthropy Banking | Amalgamated Bank

Brian Edwards

Associate Editor | Tribal Business News

Vanessa Farley

Chippewa Cree Tribe of Rocky Boy Indians

Director of Tribal Energy Programs | MTERA

Kyle Felsman

Confederated Salish and Kootenai Tribes

Tribal Program Director | GRID Alternatives

Wizipan Garriott

Rosebud Sioux Tribe of South Dakota

Principal Deputy Assistant Secretary – Indian Affairs | U.S. Department of the Interior

Toniqua Hay

Stakeholder Engagement Lead | Energy Improvements in Rural or Remote Areas | Office of Clean Energy Demonstrations | U.S. Department of Energy

Janie Hipp

Chickasaw Nation

President & CEO | Native Agriculture Finance Services

Ellen Lurie Hoffman

Director | Center for Impact Finance | Carsey School of Public Policy

Dennis Ickes

CEO | Tule River Economic Development Corporation

Brett Isaac

Navajo Nation

Chris James

President & CEO | National Center of the American Indian Enterprise Development

Amir Kirkwood

CEO | Justice Climate Fund

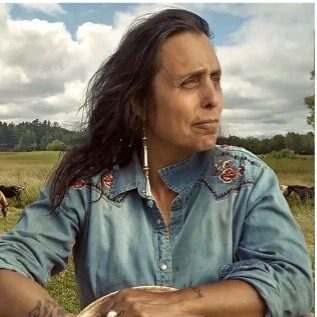

Winona LaDuke

Anishinaabe

Author

Krystal Langholz

Chief Community Officer | Calvert Impact

Cathie Mahon

President & CEO | Inclusiv

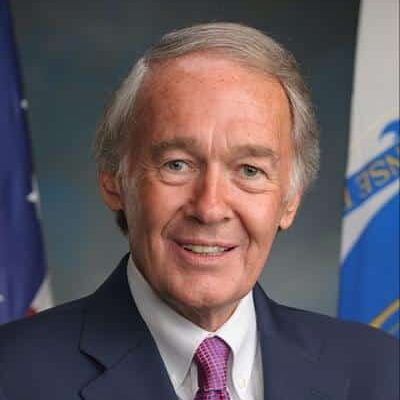

Edward Markey

United States Senator for Massachusetts

Karla Miller

Vice President | Northwest Area Foundation

Jonathan Morgenstein

Senior Project Manager | National Renewable Energy Laboratory (NREL)

Jane Nishida

Acting Deputy Administrator and Assistant Administrator | Office of International and Tribal Affairs | Environmental Protection Agency

Kerry O'Neil

CEO | Inclusive Prosperity Capital, Inc.

Kim Pate

Eastern Band Cherokee, Mississippi Choctaw

Managing Director | NDN Fund

Dhruv C. Patel

Co-Founder & CEO | Syncurrent

Dominic 'Nick' Parker

Anderson-Bascom Professor | University of Wisconsin – Madison

Ted Piccolo

Confederated Tribes of the Colville Reservation

Senior Director | Indigenous Futures Fund | Mission Driven Finance

Harold Pettigrew

President & CEO | Opportunity Finance Network

Pam Porter

CFO | Green Bank for Rural America | Appalachian Community Capital

Pravina Raghavan

Director | CDFI Fund | U.S. Department of the Treasury

Ian Record

Consultant | Ian Record Consulting

Greg Rickford

Member of Provincial Parliament | Kenora – Rainy River | Ontario Legislature | Minister of Indigenous Affairs & First Nations Economic Reconciliation

Zakaria Shaikh

Consultant | State Small Business Credit Initiative (SSBCI) | U.S. Department of the Treasury

Dennis Smith

Affordable Lending Manager | Single-Family Acquisitions Division | Freddie Mac

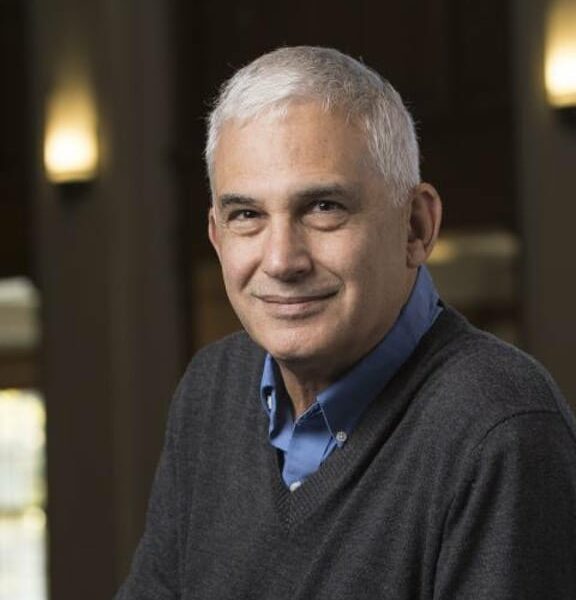

Michael Swack

Carsey Senior Fellow Research Professor | Center for Impact Finance

Pete Upton

Ponca Tribe of Nebraska

CEO | Native CDFI Network & Executive Director | Native 360 Loan Fund

Jesse Van Tol

President & CEO | National Community Reinvestment Coalition

Kristen Wagner

National Program Director | Native CDFI Network

Kevin Walker

President & CEO | Northwest Area Foundation

Additional speakers will be announced soon!

Sheila D. Herrera

Executive Director | Tiwa Lending Service

Sheila D. Herrera is the Executive Director of Tiwa Lending Services with over 35 years’ experience in the lending industry and with experience in coordinating and directing the implementation of economic/community development. As Tiwa Lending Services’ Executive Director, Ms. Herrera operates and manages Tiwa Lending Services, performing all home loan activities, including the origination and underwriting of loans, providing financial and homeownership counseling, preparing loan documents, closing loans, monitoring construction, disbursing payments and tracking the loan capital. Ms. Herrera is one of the founding members of Tiwa Lending Services. She was instrumental in developing the incorporation documents to establish Tiwa Lending Services and in developing the organizational and developmental capacity of Tiwa Lending Services. Ms. Herrera’s duties include planning, budgeting, financial reporting, bringing in private capital, as well as long-range planning to provide business lending and other financial related products and services.

Prior to coming to work with Tiwa Lending Services, Ms. Herrera managed the Isleta Pueblo Housing Authority’s Home Loan Program and served as a Homeownership Counselor. Ms. Herrera owned a mortgage brokerage business for seven years and worked in the banking industry. Ms. Herrera is a certified Homeownership Counselor and provides one-on-one counseling to applicants and borrowers. She also conducts Homeownership and Financial Literacy and Education workshops for Isleta Pueblo community members.

Pilar M. Thomas

Pascua Yaqui Tribe

Partner | Quarles and Brady, LLC

Pilar Thomas is a partner in the firm’s Energy, Environment & Natural Resources Practice Group. She focuses her practice on tribal renewable energy project development and finance, tribal economic development, federal Indian Law, and natural resource development.

Pilar assists clients with strategic legal advice on tribal energy policy and planning; clean energy and infrastructure project development and finance; federal and state energy regulatory, programs, and policy efforts; and federal requirements for tribal lands development. She has negotiated or assisted with agreements related to transmission lines, landfill gas, solar projects, a natural gas power plant, and mineral development on tribal lands. She serves as general counsel for several tribes, Section 17 and tribal business entities.

Representative Matters

- Negotiate leases and right of ways for utility scale renewable projects

- Shepherd through federal regulatory process for land into trust decisions and related environmental reviews

- Draft HEARTH Act leasing regulations

- Draft tribal laws, regulations, and policies related to economic development, land use, and environmental review

- Tribal consultation practices

- Monitor, review, and draft comments on federal and state agency actions

- Monitor, review, and draft federal legislation related to tribal energy development

Prior to entering private practice, Pilar was the Deputy Director for the Office of Indian Energy Policy and Programs at the US Department of Energy, where she was responsible for developing and implementing policy and program efforts within the department and federal government to achieve the office’s policy objectives related to the promotion of energy development, electrification, and infrastructure improvement on tribal lands. She also is the former Deputy Solicitor of Indian Affairs for the US Department of the Interior; served as the Interim Attorney General and Chief of Staff to Chairwoman Herminia Frias of the Pascua Yaqui Tribe; and was a trial attorney in the US Department of Justice, Environmental and Natural Resources Division, Indian Resources Section.

Mel Willie

Navajo Nation

Director of Native Partnerships and Strategy | NeighborWorks

Mel Willie leads NeighborWorks America’s Native work to expand its investment in tribal communities. He is a national leader in Indian Country with more than 23 years of experience in nonprofit management, government, political, public and intergovernmental affairs and has represented tribal interests at the local, tribal, state and national level. He is a member of the Navajo Nation, born and raised on the reservation in northeast Arizona.

Before joining NeighborWorks, he served as principal of Chee Consulting, working with a range of clients to advance and strengthen tribal communities. Having served as past executive director of the National American Indian Housing Council (NAIHC) and as special advisor to one of the nation’s largest public housing authorities, he is intimately familiar with providing affordable housing through highly regulated federal programs. Kennedy school.

Michou Kokodoko

Project Director – Community Development and Engagement |Minneapolis Federal Reserve | Center For Indian Country Development

Michou Kokodoko is a project director in the Minneapolis Fed’s Community Development and Engagement department. He leads the Bank’s efforts to promote effective community-bank partnerships by increasing awareness of community development trends and investment opportunities, especially those related to the Community Reinvestment Act.

Chrystel Cornelius

Ojibwe; Oneida

CEO & President | Oweesta

Chrystel Cornelius is the President & CEO of the Oweesta Corporation, a national Native CDFI intermediary predominantly serving Native communities across the United States, Alaska, and Hawaii.

Ms. Cornelius has worked with Native communities for most of her professional career, with more than 23 years of experience working in the Native economic development field. She is an enrolled member of the Oneida Nation of Wisconsin and a member of the Turtle Mountain Band of Chippewa Indians located in North Dakota. Ms. Cornelius has dedicated her career to capitalizing Native communities upholding tribal sovereignty and self-determination measures through the issuance of capital and organizational capacity building efforts.

Chrystel Cornelius is a founding steering committee member and previously held the position as the Board Secretary for the Native CDFI Network (NCN). Ms. Cornelius is also a former board member of Opportunity Finance Network (OFN), is a current board member of the Community Reinvestment Fund (CRF) and holds the position of Treasurer for the Red Feather Development Group. She is a BALLE Fellow and Skoll Fellow.

Ms. Chrystel Cornelius attained a bachelor’s degree in Business Management from the University of Mary in Bismarck, North Dakota.

Angie Main

Fort Belknap Gros Ventre Tribe

Executive Director | NACDC Financial Services, Inc.

Professional background includes over 30 years’ experience in grants administration & management, fund raising, business and financial literacy education, training and technical assistance for small business, and community development in Tribal communities. Since 2011, Executive Director for NACDC Financial Services, Inc., a Native Community Development Financial Institution (CDFI), located in Browning, MT, providing training, technical assistance and capital access to the eight (8) Montana Reservation communities. Since 2010, fundraised over $15 m in lending and operating capital.

Experience includes leveraging resources for housing, community and organizational development; business; non-profit; strategic and business planning; and resource development.

Former employment includes Executive Director, Montana Tribal Business Information Network, Missoula, MT; and Vice President, Fort Belknap College, Fort Belknap, MT. Current board member for Blackfeet Reservation Development Fund, Montana Nonprofit Association and Montana Community Foundation. Received the 2017 Visionary Leader Award at the annual Native CDFI Awards Reception and Ceremony, OFN Conference in Washington, D.C. Enrolled member of the Montana Fort Belknap Gros Ventre Tribe.

Rohit Chopra

Director of the Consumer Financial Protection Bureau

Rohit Chopra is Director of the Consumer Financial Protection Bureau. As Director, Chopra is also a member of the Board of Directors of the Federal Deposit Insurance Corporation and the Financial Stability Oversight Council. In 2018, Chopra was unanimously confirmed by the U.S. Senate as a Commissioner on the Federal Trade Commission, where he served until assuming office as CFPB Director. During his tenure at the FTC, he successfully worked to strengthen sanctions against repeat offenders, to reverse the agency’s reliance on no-money, no-fault settlements in fraud cases, and to halt abuses of small businesses. He also led efforts to revitalize dormant authorities, such as those to protect the Made in USA label and to promote competition. Chopra holds a BA from Harvard University and an MBA from the Wharton School at the University of Pennsylvania.

Tawney Brunsch

Oglala Sioux Tribe

Executive Director of Lakota Funds

Tawney Brunsch, a member of the Oglala Sioux Tribe, is the Executive Director of Lakota Funds, a Native community development financial institution (CDFI) serving the Pine Ridge Reservation in South Dakota. Prior to joining Lakota Funds in 2008, Tawney worked with the Black Hills Federal Credit Union for eight years as a Branch Manager/Lead Lender. At Lakota Funds, Tawney has successfully led the organization’s achievement of key organizational benchmarks, including the chartering of the Lakota Federal Credit Union, expanding Lakota Funds’ lending area to the Rosebud Reservation, efforts to become an FSA-Guaranteed ag lender, and launching the Child Development Account (CDA) program, one of the first such programs in Indian Country. Nationally known for her community development efforts, Tawney serves on a number of boards and advisory committees including the Federal Home Loan Bank of Des Moines Advisory Council, the Community Advisory Council of the Federal Reserve Board, and the Native CDFI Network’s Policy Committee.

Tawney remains committed to economic development on the Pine Ridge Reservation in her roles as Lakota Federal Credit Union Board Chairman, and the Board Treasurer of Mazaska Owecaso Otipi Financial, a fellow CDFI focused on homeownership lending. She has been a leader of the South Dakota Native Homeownership Coalition since its creation in 2013, and currently serves on the Executive Committee, Policy Committee, and Veteran’s Committee and chairs the Physical Issues Committee.

CEO | Native CDFI Network & Executive Director | Native 360 Loan Fund

In addition to serving as NCN’s CEO and Chairperson, Pete Upton (Ponca Tribe of Nebraska) is the Executive Director of Native360 Loan Fund, a certified Native Community Development Financial Institution that focuses on entrepreneurship and financial literacy development for Native Americans. Serving as Executive Director since 2011, Mr. Upton has built the organization from its start-up phase into a successful lending organization that continues to experience growth while ever increasing its community impact. Mr. Upton has been involved with the Native CDFI Network since it was a grassroots movement. From 2011-2012, he served on the steering committee that was instrumental in the Native CDFI Network’s initial organizational development steps. In 2012, Mr. Upton became a founding board member and served as the Chairperson for the Peer Learning Committee. As Native360 serves Native communities in three states, Mr. Upton understands the challenges of serving both rural and urban areas in various different jurisdictions. He values strong networks and cultivates partnerships to deliver technical assistance throughout a vast service area. Mr. Upton is a powerful advocate for equal access to capital. Senior Advisor, Policy & Tax | Alliance for Tribal Clean Energy

Wendolyn Holland leads the critical policy and tax advocacy work of the Alliance. She has spent the last seven years of her career supporting tribes in achieving their clean energy goals by serving as an interface with federal and state agencies. She served as Senior Advisor for Commercialization in the Office of Energy Efficiency and Renewable Energy at the U.S. Department of Energy from 2008 through 2011. The position fostered national lab stewardship and was designed to carry these ideals from the Bush Administration into the Obama Administration. Holland served in 2012 as Director for Strategic Development and Technical Partnerships at Savannah River National Lab, which serves DOE’s Office of Environmental Management. Prior to federal service, she worked with clean energy and water start-up firms as either an owner or consultant. She responded to the terrorist attacks of 2001 by joining Global Options, a Washington, D.C. security, investigations, and counter-terrorism start-up, later serving as Vice President. Holland received her MBA in Finance and Strategy from Kellogg School of Management in 2001 and her BA in History and Studies in the Environment from Yale in 1991. Director of Strategy | Calvert Impact

Krystal Langholz is a Director of Strategy for Calvert Impact, supporting new product and program development. She assists the design and launch of new products that are built in response to market gaps. Krystal oversees the implementation of new programs and ensures that the lessons learned from these programs are disseminated with partners. She also supports syndicated transactions and provides general thought leadership to inform future strategy. Before her time at Calvert, Krystal served as the Chief Operating Officer and Executive Vice President of Strategy and Capitalization of the Oweesta Corporation, a national Native Community Development Financial Institution (CDFI) intermediary. Before her tenure at Oweesta, Krystal served as the founding Executive Director of Hunkpati Investments, a certified Native CDFI on the Crow Creek Indian Reservation in South Dakota. She holds a MA in cultural anthropology from Colorado State University and BA from Luther College. Krystal lives in Fort Collins, Colorado, with her husband, two children, and a golden doodle. National Program Director | Native CDFI Network

Kristen Wagner serves as the Native CDFI Network’s National Program Director. In this role, Wagner manages NCN grant funded programs, Membership Programs, and oversees the design and delivery of capacity-building supports to NCN members. Dr. Wagner built her 25-year career with a commitment to building more equitable economies in Native communities across the country and Indigenous communities globally. Director | Office of Tribal and Native Affairs | U.S. Department of the Treasury Fatima Abbas (Haliwa Saponi) serves as the first director of the U.S. Department of the Treasury Office of Tribal and Native Affairs. In this role she works with U.S. Treasurer Lynn Malerba, chief of the Mohegan Tribe, and the Treasury Tribal Advisory Committee to address needs identified by tribal leaders. Prior to this role, Abbas served as senior advisor to the Treasury Department in the Office of Recovery Programs, where she worked on the implementation of over $22 billion in relief funds to tribal governments to support their public health and economic recovery. Previously, Abbas served as the vice president of government relations for the National Congress of American Indians, where she supervised a seven-person policy team with a portfolio covering economic development and taxation. Abbas also served as the first in-house general counsel for the Karuk Tribe located on the California-Oregon border. During her service at Karuk, Abbas worked on a range of commercial matters, including financing, construction, and operation of the tribe’s first gaming facility and multiple tax-credit projects. Additionally, she served as a supervisory attorney for the Karuk Berkeley Collaborative, a tribal student clinic at the University of California, Berkeley School of Law that conducted research on natural resources and cultural resource issues. Prior to her service to the Karuk Tribe, Abbas served as deputy attorney general for the Colorado River Indian Tribes (CRIT) located in Western Arizona and Eastern California, where she worked on civil matters and prosecuted crimes on the reservation. Prior to working for CRIT, Abbas was a commercial litigation associate at Fox Rothschild, LLP, in the Philadelphia area. She is originally from urban Philadelphia and is a graduate of the Community College of Philadelphia, Temple University, and the University of California, Berkeley School of Law. During law school, Abbas interned with numerous organizations, including the Native American Rights Fund. She is a licensed attorney in California, Arizona, Pennsylvania, and New Jersey. Energy Counselor | USDA Rural Development Clare Sierawski is the Energy Counselor for Rural Development at the U.S. Department of Agriculture (USDA). She is a clean energy and climate change policy expert with over 15 years of experience in the field. Before USDA, she was working at the White House as the Special Assistant to the President for Climate Change Finance. She currently works to administer roughly $13 billion in funding for clean energy from the Inflation Reduction Act to benefit rural communities. Previous to that, she spent over five years working on clean energy development and deployment with governments and developers across West Africa based in Ghana, and before that she was the Chief of Staff for the Office of the Special Envoy for Climate Change at the U.S. Department of State where she managed the development of U.S. international climate policy and was instrumental in the Paris Climate Agreement and the U.S.-China climate change agreement. Clare holds a Master in Public Affairs from Princeton University and majored in Environmental Studies, Chinese, and Political Science at the University of Pittsburgh. State Small Business Credit Initiative | U.S. Department of the Treasury (Contractor) Zakaria Shaikh serves as a Consultant to the U.S. Department of the Treasury for the State Small Business Credit Initiative (SSBCI). He worked on the first iteration of the SSBCI program as an outreach manager and venture capital subject matter expert. Previously, he managed state venture capital programs, and held executive roles in strategy and operations for startups and large organizations. He holds an undergraduate and graduate degree in public health from the University of Southern California, and an MBA from the University of Michigan. Deputy Assistant Secretary for the Office of External and Intergovernmental Affairs Rudy Soto serves as the Deputy Assistant Secretary for the Office of External and Intergovernmental Affairs and responsible for the External and Intergovernmental Affairs team. Previously Rudy Soto served as USDA’s Rural Development State Director for Idaho since January 2021. In this role, Soto was instrumental in promoting economic development, increasing access to healthcare, and improving infrastructure in Idaho’s rural communities. Before that, Soto served as a legislative staffer in the U.S. House of Representatives, covering energy, environment, agriculture, and tribal affairs. Previously, he worked for Western Leaders Network, a nonprofit organization of local and tribal elected officials across the Interior West focused on protecting public lands, water, and air. Soto was born and raised in Nampa, Idaho, and is a proud member of the Shoshone Bannock Tribes of the Fort Hall Reservation and a veteran of the United States Army National Guard. He earned a bachelor’s degree from Portland State University. Advisor, Environmental Impact | ESG Engagement & Impact | Fannie Mae Sean Skulley is Advisor, Environmental Impact, on Fannie Mae’s ESG Engagement & Impact Team. Sean works with Single-Family and Multifamily business partners to develop strategies, plans, and programs to achieve Fannie Mae’s ESG and Duty to Serve goals. He helps drive the business’ engagement and impact on key ESG issues, including but not limited to affordable housing, sustainable housing, consumer education, climate change mitigation, and green homes. Prior to Fannie Mae, Sean worked in the utility industry and in environmental consulting, leading teams and programs that advanced the issues of energy efficiency, renewable energy, and greenhouse gas reductions. Sean received his MBA from The George Washington University and a B.A. in Environmental Policy from Colby College. Lead Associate, Duty to Serve | Engagement and Impact | Fannie Mae Engagement Caroline is a Lead Associate, Duty to Serve on Fannie Mae’s Engagement and Impact team in the ESG and Mission Department. Caroline provides leadership on Single-Family and Multifamily projects that support the three underserved DTS Markets: Rural Housing, Manufactured Housing, and Affordable Housing Preservation Market Plans. In her role, Caroline is focused on partnering with internal and external stakeholders on expanding Fannie Mae’s Native American Conventional Lending Initiative. Prior to joining Fannie Mae, Caroline worked at Education Advisory Board as a Senior Analyst in their Contract and Pricing Strategy Group where she led the launch of a new Salesforce Contracting system and developed a project to support relationships with Historically Black Colleges and Universities (HBCUs), helping schools access tools to increase student retention and graduation rates. Caroline is a graduate of Providence College in Rhode Island with a Bachelor of Science degree in Health Policy and a Minor in French Studies. Caroline is an avid runner and was an NCAA Division I Collegiate Track and Field athlete while at Providence. Senior Advisor | Rural Utilities Service (RUS) | USDA Jaime Jackson is a Senior Advisor for the Rural Utilities Service (RUS), US Department of Agriculture. Since joining RUS, Jaime facilitated launching and managing USDA’s $13 billion in Inflation Reduction Act funding for clean energy in rural America. Prior to joining RUS, Jaime served as Director of Investments at a clean energy finance authority where she led over $25 million in deployment of capital that financed renewable projects and benefited affordable community housing. Before that, she spent over 11 years at the Export-Import Bank of the U.S. where she led a $1.2 billion portfolio of power, mining, and high-technology corporate and project finance transactions spanning across Asia Pacific, Europe, Africa, and Latin America. Jaime successfully negotiated with governments, multilateral development banks and private equity firms to ensure contractual relationships, repayment of debt, and protection of assets. Jaime holds a Master of Business from the University of Maryland Robert H. Smith School of Business and is a proud alumnus from Clark Atlanta University. Policy and Markets Program Manager | State of Maine Governor’s Energy Office Ethan Tremblay serves as Policy and Markets Program Manager for the Governor’s Energy Office, focusing on a variety of renewable energy and grid modernization policy initiatives. Before joining the office, he worked in the private sector providing energy efficiency program administrators and utilities with program evaluation, customer analytics, and data management services. Ethan earned his Master of Science in Resource Economics and Policy from the University of Maine. Clean Energy Partnership Program Manager | State of Maine Governor’s Energy Office Tagwongo Obomsawin is the Clean Energy Partnership Program Manager for the State of Maine Governor’s Energy Office. In this role, she administers programs that support clean energy workforce development and innovation to advance Maine’s clean energy, climate, economic development, and workforce goals – including Governor Janet Mills’ goal of more than doubling Maine’s clean energy and energy efficiency jobs by 2030.

Chief of Staff | Rural Business Cooperative Service | USDA RD Leroy Garcia serves as the Chief of Staff to the USDA Rural Business-Cooperative Service Administrator Betsy Dirksen Londrigan. USDA’s RBCS offers programs to help businesses grow as well as job training for people living in rural areas. RBCS programs help provide the capital, training, education and entrepreneurial skills that can help those living in rural areas start and grow businesses or find jobs in agricultural markets and in the bio-based economy. Prior to joining USDA, Garcia was the Special Assistant to the Assistant Secretary of the Navy for Manpower and Reserve Affairs at the Department of Defense. In 2014, Garcia was elected to represent Colorado’s 3rd State Senate District, covering Pueblo, Pueblo West, and part of Salt Creek. He became Assistant Minority Leader at the start of the 2017 Legislative Session and Senate President at the start of the 2019 Legislative Session. In 2020, he was unanimously re-elected to continue in his role as Senate President for the 73rd General Assembly. During the 2020 presidential election, Joe Biden selected Senator Garcia to serve on his national Latino Leadership Committee, as well as a co-chair of Colorado’s Latino Leadership Committee. Prior to the Colorado Senate, Senator Garcia served in the Colorado House of Representatives. From 2001 to 2007, Garcia served in the U.S. Marine Corps and deployed to Iraq as a mortuary affairs specialist in 2003. Garcia is a first-generation college graduate with a master’s degree in organizational management from Ashford University in Clinton, Iowa, a bachelor’s in management from the University of Phoenix, and an associate degree in emergency medical services from Pueblo Community College.

Executive Director | Lakota Funds Tawney Brunsch, a member of the Oglala Sioux Tribe, is the Executive Director of Lakota Funds, a Native community development financial institution (CDFI) serving the Pine Ridge Reservation in South Dakota. Prior to joining Lakota Funds in 2008, Tawney worked with the Black Hills Federal Credit Union for eight years as a Branch Manager/Lead Lender. At Lakota Funds, Tawney has successfully led the organization’s achievement of key organizational benchmarks, including the chartering of the Lakota Federal Credit Union, expanding Lakota Funds’ lending area to the Rosebud Reservation, efforts to become an FSA-Guaranteed ag lender, and launching the Child Development Account (CDA) program, one of the first such programs in Indian Country. Nationally known for her community development efforts, Tawney serves on a number of boards and advisory committees including the Federal Home Loan Bank of Des Moines Advisory Council, the Community Advisory Council of the Federal Reserve Board, and the Native CDFI Network’s Policy Committee. Tawney remains committed to economic development on the Pine Ridge Reservation in her roles as Lakota Federal Credit Union Board Chairman, and the Board Treasurer of Mazaska Owecaso Otipi Financial, a fellow CDFI focused on homeownership lending. She has been a leader of the South Dakota Native Homeownership Coalition since its creation in 2013, and currently serves on the Executive Committee, Policy Committee, and Veteran’s Committee and chairs the Physical Issues Committee.

Board Member | Maine Association of Nonprofits Jayne is an independent consultant. She previously served as Development Director for Broadreach Family and Community Services and CEO of Mainestream Finance, the Community Development Finance Institution of Penquis Community Action Program. She was former Vice President of Commercial Banking at Machias Savings Bank, as well as a Vice President & Market Manager at Camden National Bank, and a Senior Vice President at Key Bank. Jayne also served for four years as a State Representative for House District #43 and served on the Appropriations and Financial Affairs Committees. Finance & Loan Analyst | Policy, Analysis, and Communications Division | Single-Family Housing Guaranteed Loan Program | USDA Rural Development I began my career with USDA Rural Development over 18 years ago, working as a student intern while attending Fort Valley State University (FVSU). For the past 3 years, I have specialized in the Guaranteed Loan program. Throughout my time at the agency, I have gained valuable experience across many of Rural Development’s programs including housing, multi-family housing, community programs, and business and industry loans. As a Finance & Loan Analyst, one of my primary duties is keeping the SFH Guaranteed Loan Program Technical Handbook up-to-date by reviewing and revising policies to ensure they remain current. I also develop program-related workplans and draft rules and guidance. In addition, I respond directly to general questions from the public submitted via email and through the CALL USDA phone line. I take pride in helping people access Rural Development’s resources and in furthering the agency’s mission. Relationship Manager for Native CDFIs | Fahe Susan Hammond is the Relationship Manager for Native CDFIs at Fahe, a CDFI serving in rural and Native communities with a mission to building the American Dream of homeownership. Her main focus is to develop strong partnerships with Native CDFIs by providing training and support in accessing the secondary mortgage market, which will increase access to capital for NCDFIs while also addressing the severe housing needs faced by Native families and communities. Susan is a citizen of the Penobscot Nation, a tribe in central Maine. She has dedicated her career to growing investments in Native economies and serving Native communities. Executive Director | Four Directions Development Corporation Matthew is a citizen of the Passamaquoddy Tribe at Sipayik with comprehensive expertise in non-profit sectors and community development financial institutions. He is the Executive Director at Four Directions Development Corporation. In this role, Matthew champions the preservation of Wabanaki culture and traditions through economic development efforts. Matthew has over a decade of experience working alongside Municipal, State, Tribal, and Federal Governments, administering revolving loan funds and executing community development projects. Outside of his professional life, he enjoys crafting intricate Excel formulas, tinkering with electronics to automate household tasks, and exploring the scenic Maine woods with his wife. Director of Homeownership | cdcb Linda Marin is the Director of Homeownership for cdcb. Linda has been with cdcb for 25 years. Linda holds a B.B.A. degree in Finance from the University of Texas at Austin, and previously worked for the Washington Mutual as a DE Underwriter. She is responsible for underwriting all loans and issuing loan commitments for all cdcb loan products as well as coordinating cdcb’s entire mortgage lending operations from loan application through closing. Rio Grande Valley Multibank CDFI Operations Manager | cdcb Nadia Erosa is the Rio Grande Valley Multibank CDFI Operations Manager for cdcb. Nadia has been with cdcb for 15 years & administers the cdcb Loan Servicing Department, the RGV Multibank CDFI and its subsidiary The Community Loan Center (the Small Dollar Loan Program) and its nationwide CLC Franchises. Nadia oversees loan origination process, program compliance for both the mortgage and SDLP servicing. She was an integral part of a unique, proprietor loan servicing software used by their SDLP and its Franchises. Lender and Partner Activities Team | USDA Rural Development Ed grew up on a farm in rural south Georgia and graduated from the University of Georgia (Go Dawgs!) with a Bachelor’s degree in Agricultural Economics. A thirty-five+ year employee of USDA Rural Development, he has served in numerous roles, including Loan Officer, Appraiser, Underwriter, Collecting Agent, and Construction Inspector in USDA RD Local Offices across Georgia. He has also held positions as Specialist and Program Director for the Single Family Housing programs in Georgia’s USDA State Office. He now serves on USDA’s National Headquarters staff serving on the Lender and Partner Activities team focusing on partner training and outreach. He lives in Blackshear, Georgia with his wife of 39 years – together, they have three grown children. CEO | Navajo Power

Brett Isaac, a proud member of the Navajo Nation, raised in a small community called Baby Rocks, is the Chief Executive Officer of Navajo Power. Born of the Towering House Clan and for the Salt Clan, Brett graduated from the University of Arizona, focused on empowering Indigenous communities with sustainable energy solutions. As CEO of Navajo Power, Brett has gone beyond conventional business strategies, leading efforts to expand solar and battery storage projects on the Navajo Nation that promote equity in large-scale utility projects. Brett also founded Navajo Power Home, which provides solar installations with unique payment plans for Navajo and Hopi families. This initiative enhances access to clean energy solutions that are culturally and financially tailored for Indigenous families. Together, both companies are working together to develop a just energy transition for Tribal communities, where all families have power. Carsey Senior Fellow Research Professor | Center for Impact Finance

Michael Swack is a professor at the University of New Hampshire, where he has appointments at the Carsey School of Public Policy and at the Peter T. Paul College of Business and Economics. He founded the Center for Impact Finance in 2013 and served as director through 2023. He currently serves as a senior fellow at the Center. He also started the Master’s Program in Community Development at UNH, a program designed for adult practitioners. He continues to teach in that program. At Carsey, he works on building scale in the community development finance sector, innovations in community development finance, microfinance, and equitable clean energy financing. He also directs the Financial Innovations Roundtable, an annual convening hosted by the Federal Reserve Bank. He has over forty years of experience in the fields of economic development, finance, and development banking. Michael was the founder and former dean of the School of Community Economic Development (CED) at Southern New Hampshire University. He has been involved in the design, implementation, and management of a number community development lending and investment institutions both inside and outside the United States. He was the first chairman and served for seventeen years as a board member of the New Hampshire Community Development Finance Authority (CDFA), a state-chartered equity fund for community economic development ventures and projects. He is the founding president and a current board member of the New Hampshire Community Loan Fund. He was a founding board member of the National Association of Community Development Loan Funds (now the Opportunity Finance Network), a trade association of Community Development Finance Institutions. Internationally, he has been involved in development finance and microfinance work in Africa, Asia, and Latin America. In 2019, the Opportunity Finance Network (OFN) awarded Michael the 2019 Ned Gramlich Lifetime Achievement Award for Responsible Finance—the community development finance institution (CDFI) industry’s highest individual honor. In 2021, Michael was appointed by President Biden to the U.S. Department of the Treasury’s Community Development Advisory Board. Michael has published in the areas of economic development and development finance. He received his doctorate degree from Columbia University, his master’s degree from Harvard University, and his bachelor’s degree from the University of Wisconsin-Madison. CCIA Program Manager | Native CDFI Network

Pamela Boivin (Menominee Indian Tribe of Wisconsin) serves as the Native CDFI Network’s CCIA Program Manager. In addition to overseeing the CCIA Regional Coordinator team, her role is instrumental in supporting that capacity of Native CDFIs to build a clean energy finance infrastructure that promotes clean energy investments in Native communities. Prior to joining NCN, Mrs. Boivin led Woodland Financial Partners, a Native CDFI located on the Menominee Reservation in Wisconsin. The company empowers generational wealth and access to capital for Wisconsin’s Tribal communities. She advocates for cultural awareness in the lending industry as a channel for increasing financial literacy and access to capital in Indian Country. Boivin received her Master of Business Administration from Marquette University and the National Center for American Indian Enterprise Development 40 Under 40 Award in 2022. Her professional journey, marked by dedication and continuous learning, has led her to her current role as the NCN CCIA Program Manager. Pam has dedicated 17 years of service to the Native CDFI industry and will champion the clean energy movement with NCN. President & CEO | The National Center for American Indian Enterprise Development

Chris James is President and CEO of the country’s foremost and oldest Native American and Alaska Native business and economic development-focused organization, The National Center for American Indian Enterprise Development. Chris is an expert on the Indigenous economy, Native American policy, and economic development, particularly in rural and disadvantaged communities. Chris speaks from first-hand knowledge and experience; his family owned several businesses on the Qualla Boundary in western North Carolina – the reservation for the Eastern Band of Cherokee Indians. Chris has guided The National Center into its sixth decade. Under his leadership, The National Center has more than doubled its annual revenue, expanded its national footprint, and grown its staff. In addition to hosting the annual Reservation Economic Summit (RES) – the largest conference and trade show focused exclusively on the American Indian economy – The National Center has implemented the Native Edge Institute series, one-day training sessions designed to give both established and emerging entrepreneurs the tools they need to take their next step. Under Chris’s leadership, The National Center has an increased focus on international trade, in particular Indigenous-to-Indigenous trade. The organization also serves as an important connector between corporate America and Native-owned businesses seeking to enter their supply chains. As a former senior official in Department of Treasury and Small Business Administration (SBA) for the entirety the Obama administration, Chris has unique expertise in government contracting, supply chains, underserved markets, community development financial institutions and access to capital, and issues affecting small business issues. One of the initiatives he led at SBA – Startup in a Day – was praised by President Obama during his 2016 State of the Union address. Chris serves on numerous boards and leadership committees, including with the SBA, Federal Communications Commission, World Trade Organization, the Center for Indian Country Development at the Federal Reserve Bank of Minneapolis (where he co-authored a paper on COVID-19’s impact on Native American businesses and entrepreneurs), Junior Achievement USA, and First Peoples Worldwide. He is a frequently requested speaker, panelist, moderator, and guest for a wide variety of conferences, events, and organizations. He has testified on Native American and Alaska Native policy before Congress. Author, Activist, Environmentalist

LaDuke is a Anishinaabe from the White Earth reservation in northern Minnesota, or Akiing, the Land to Which the People Belong. She is an author, rural development economist, farmer, and long time environmental and Indigenous rights activist. She began work in the late l970s on the rights of Indigenous Peoples at the United Nations, worked extensively on energy policy issues from uranium and coal strip mining to pipelines and dam projects, with a strong background in community and environmental impacts and experience with the political repression associated with resistance. In her community, she’s worked on oral history and land rights issues, environmental advocacy and renewable energy projects- including a pending half a megawatt project for her own village of Pine Point on the White Earth reservation. She’s been arrested and to the White House, and was a two time Green Party nominee for the office of Vice President of the United States. She also holds the distinction of having received an electoral college vote for the office of U.S. President. She’s thankful she is not President, and in her long and colorful career has authored seven books, including a novel, Last Standing Woman, works as a curator at the Giiwedinong Museum of Treaty Rights and Culture and grows fiber hemp. She‘s a graduate of Harvard University and has a Masters Degree in Rural Development. United States Senator for Massachusetts Whether the issue is climate change, clean energy, safeguarding privacy, nuclear non-proliferation, investor protection or preserving an open Internet that spurs competition and consumer choice, Senator Markey stands up for the priorities and values of Massachusetts. While serving for 37 years in the U.S. House of Representatives, Senator Markey fought for his constituents throughout his Congressional District. When he was Dean of the Massachusetts delegation in the House, he worked to harness the energy and influence of his colleagues on behalf of the entire Commonwealth. Elected to the Senate in a special election in June 2013, Senator Markey is bringing his experience, energy and expertise to fight for all the people of Massachusetts. Senator Markey has amassed an unparalleled record of energy and environmental legislative achievements. He has consistently fought to create new jobs in American clean energy and served as a leading consumer champion against rising gas prices and foreign oil. He is the principal House author of the 2007 fuel economy law, which will increase fuel economy standards to 54.5 miles per gallon by 2025, the first increase in a generation. He also is the author of the appliance efficiency act of 1987, which stopped the construction of hundreds of coal-fired plants. Senator Markey authored the law that established the Northeast Home Heating Oil Reserve, ensuring that New England families won’t be left out in the cold when oil prices spike. And he is the author of the revolutionary law that requires electricity regulators to open up the wholesale electric power market for the first time. In 2009, Congressman Markey was the co-author of the landmark Waxman-Markey bill, the only comprehensive climate legislation ever to pass a chamber of Congress. It gave hope to the world that the United States was serious about addressing climate change and helped America effectively negotiate with the international community. Senator Markey was a leading voice in the investigation into the BP oil spill. He insisted that the company reveal the true size of the spill’s flow rate, raised concerns about the use of toxic chemical dispersants into the environment and forced BP to make live video footage of the oil spill available to the public on the “Spillcam” website he created. BP ultimately pled guilty to 14 counts, including one count of Obstruction of Congress for making false and misleading statements and withholding information and documents from then-Rep. Markey about the true size of the spill. In the House of Representatives, Congressman Markey served as the Ranking Member of the Natural Resources Committee. From 2007 to 2010, he served as Chairman of the Select Committee on Energy Independence and Global Warming, a signature committee established by then-Speaker Nancy Pelosi. He also served on the Energy and Commerce Committee, where he was Chairman of the Subcommittee on Energy and the Environment. A member of the Commerce, Science and Transportation Committee, Senator Markey is a national leader on telecommunications policy, technology and privacy. In the House, he served for 20 years as Chair or Ranking Member of the Subcommittee on Telecommunications and the Internet, where he fostered the growth of new information technologies and was the principal author of many of the laws now governing our nation’s telephone, broadcasting, cable television, wireless, and broadband communications systems. He is the House author of the 1992 Cable Act, which increased choices for millions of consumers and enabled satellite-delivered programming to be more widely offered. He also authored the law in 1993 that moved over 200 MHz of spectrum from government to commercial use, creating the 3rd, 4th, 5th, and 6th wireless phone companies. New companies entered the market with digital technology, forcing the incumbents to innovate and invest and pushing mobile phone prices down. Competition remains Senator Markey’s economic mantra–in his words, “ruthless Darwinian competition that would bring a smile to Adam Smith.” He has been instrumental in breaking up anti-consumer, anti-innovative monopolies in electricity, long-distance and local telephone service, cable television, and international satellite services. He was one of the only members of the House Commerce Committee to fight AT&T’s monopoly in the early 1980’s and is a principal author of the requirement that the Bell Operating companies accept local telephone service in the 1990’s. His pro-competition policies have directly benefited job creation in Massachusetts and throughout the country. While in the House, Congressman Markey introduced the Internet Freedom Preservation Act, the first net neutrality bill introduced in Congress, to ensure that as the Internet continues to evolve, it remains a level playing field guided by the principles of openness, competition and innovation. He also has been a key leader on providing privacy protections for personal information such as medical records, financial records, and on-line purchases. He has championed strengthening privacy protections for children and is the House author of the Children’s Online Privacy and Protection Act (COPPA), the primary law that safeguards children’s privacy online. From 2003 to 2009 in the House of Representatives, Senator Markey also served as a senior member of the Homeland Security Committee. In that capacity, he focused on closing gaps in our homeland defenses, particularly in the areas of nuclear, aviation, maritime, liquefied natural gas and chemical security. In the wake of the 9-11 attacks, he authored the first-ever mandate in the law that 100% of cargo on passenger planes is screened, and 100% of all maritime cargo is scanned before entering America’s ports. He is the author of some of the most important Wall Street reform laws since the Great Depression, including statutes that strengthened penalties against insider trading, improved federal oversight over the stock and futures markets, and reformed regulation of the government securities market. Senator Markey was born in Malden, Massachusetts, on July 11, 1946. He attended Boston College (B.A., 1968) and Boston College Law School (J.D., 1972). He served in the U.S. Army Reserve and was elected to the Massachusetts State House where he served two terms representing Malden and Melrose. He is married to Dr. Susan Blumenthal. Associate Publisher/Editor | Tribal Business News

Brian Edwards is co-founder and associate publisher/editor of Tribal Business News, a digital-first publication covering business and economic development in Indian Country. A serial entrepreneur, Edwards has launched successful ventures in media, public relations, hospitality, and other sectors, including regional business publication, MiBiz, and Michigan’s largest PR firm, Lambert, Edwards & Associates (now Lambert & Co.) His journalism career includes business reporting for the Chicago Tribune, Crain’s Detroit Business, and dozens of industry trade publications. The University of Wisconsin-Madison journalism graduate calls Vermont home. CEO | Justice Climate Fund

Amir Kirkwood is the founding Chief Executive Officer of the Justice Climate Fund (JCF), where he leads the organization’s efforts to implement the Clean Communities Investment Accelerator (CCIA) program, a key initiative of the Environmental Protection Agency’s Greenhouse Gas Reduction Fund (GGRF). With a mission to address environmental and climate justice through innovative financial solutions, JCF is at the forefront of supporting clean energy investments in under-resourced communities across the U.S. Amir brings over two decades of experience in local economic development and financial investment to his role at JCF. Prior to joining JCF, he served as President and CEO of Locus, a leading Community Development Financial Institution (CDFI), and held leadership roles at Opportunity Finance Network, Amalgamated Bank, Next Street, and Citigroup, where he contributed to the creation of the Communities at Work Fund, a national $200 million financing commitment for CDFIs. President & CEO | Inclusiv

Cathie Mahon is the PresidentCEO of Inclusiv, a national network of credit unions devoted to promoting financial inclusion and equity by expanding access to capital in low-income and communities of color. Under her leadership, the Inclusiv Network has grown to 500 community development credit unions that build wealth, resilience and empowerment in communities across 46 states, Washington DC, Puerto Rico, the US Virgin Islands and Guam. Ms. Mahon previously led the NYC Office of Financial Empowerment, the first municipal office in the nation dedicated to promoting the financial health and well-being of city residents. She has been active in philanthropy serving as the founding director of the Asset Funders Network and currently serving on the Board of Trustees of the NY Foundation. She has run her own consulting business supporting foundations, community development organizations, business and cooperatives in the US and abroad. She formerly served as a researcher for the Aspen Institute. Cathie has a passion for building cooperative institutions and unleashing the power of credit unions since she held the position of the Director of Policy and Program Development at the National Federation of Community Development Credit Unions. She has been a member, a volunteer and a board member for more than 20 years serving as Treasurer of the Lower East Side People’s FCU in Manhattan and President of the Transfiguration Parish FCU in Brooklyn NY. Contractor | State Small Business Credit Initiative (SSBCI) | U.S. Department of the Treasury

Zakaria Shaikh serves as a Consultant to the U.S. Department of the Treasury for the State Small Business Credit Initiative (SSBCI). He worked on the first iteration of the SSBCI program as an outreach manager and venture capital subject matter expert. Previously, he managed state venture capital programs, and held executive roles in strategy and operations for startups and large organizations. He holds an undergraduate and graduate degree in public health from the University of Southern California, and an MBA from the University of Michigan. CEO | Inclusive Prosperity Capital, Inc.

Kerry E. O’Neill is CEO of Inclusive Prosperity Capital, Inc., an impact investment platform that spun out of the Connecticut Green Bank to scale up impact for underserved communities and underinvested markets nationally. IPC operates at the intersection of community development, clean energy finance, and climate impact using a collection of products and strategies and an ecosystem approach to matching capital with projects through local partners. Ms. O’Neill serves as the current Chair of EPA’s Environmental Financial Advisory Board. Prior to joining IPC, Ms. O’Neill led the residential financing programs and low-income initiatives at the Connecticut Green Bank, a state entity that works with private-sector investors to create low-cost, longterm sustainable financing for clean energy to maximize the use of public funds. Her work at IPC and the Connecticut Green Bank has given her keen insight into the institutional challenges – and opportunities – associated with clean energy investing for underserved communities. Executive Vice President | Chief Strategy Officer | Opportunity Finance Network

Amber Kuchar-Bell is OFN’s Chief Strategy Officer and is responsible for strategic initiatives, corporate budgeting, and facilitating partnerships with major financial institutions, philanthropy, and new corporate partners. Prior to joining OFN, Amber was the CDFI Program and NACA Program Manager at the Community Development Financial Institutions Fund (CDFI Fund). She was responsible for the design and implementation of a $1.25 billion CDFI Rapid Response Program to help CDFIs respond to the economic hardships caused by the COVID-19 pandemic and managed over $200 million annually in grants and loans to over 300 organizations. Amber was also an investment officer for the Calvert Impact Capital, where she managed a $68 million investment portfolio of CDFIs including Native CDFIs, CDEs, and social enterprise organizations. Before joining Calvert Foundation, Amber worked at Capital Impact Partners, also a CDFI, as a commercial loan underwriter where she underwrote loans for healthcare centers, affordable housing cooperatives, and charter schools. Early in her career, Amber was Sr. Consumer Lending Loan Officer at a CDFI Credit Union, Bay Federal Credit Union. She has a Master of Public Policy from Duke University located in Durham, North Carolina, and a Bachelor of Science in International Development from the University of California Los Angeles. Executive Vice President | Chief Strategy Officer | Opportunity Finance Network

Amber Kuchar-Bell is OFN’s Chief Strategy Officer and is responsible for strategic initiatives, corporate budgeting, and facilitating partnerships with major financial institutions, philanthropy, and new corporate partners. Prior to joining OFN, Amber was the CDFI Program and NACA Program Manager at the Community Development Financial Institutions Fund (CDFI Fund). She was responsible for the design and implementation of a $1.25 billion CDFI Rapid Response Program to help CDFIs respond to the economic hardships caused by the COVID-19 pandemic and managed over $200 million annually in grants and loans to over 300 organizations. Amber was also an investment officer for the Calvert Impact Capital, where she managed a $68 million investment portfolio of CDFIs including Native CDFIs, CDEs, and social enterprise organizations. Before joining Calvert Foundation, Amber worked at Capital Impact Partners, also a CDFI, as a commercial loan underwriter where she underwrote loans for healthcare centers, affordable housing cooperatives, and charter schools. Early in her career, Amber was Sr. Consumer Lending Loan Officer at a CDFI Credit Union, Bay Federal Credit Union. She has a Master of Public Policy from Duke University located in Durham, North Carolina, and a Bachelor of Science in International Development from the University of California Los Angeles. Consultant | Ian Record Consulting Ian Record is an independent consultant with expertise in tribal governance, economic development, workforce development, constitutional reform, federal Indian policy, and related areas. He provides consulting services to Tribal Nations and Native organizations in the United States and Canada consisting of strategic planning development and implementation, tribal governance and policy analysis, executive education for tribal and organizational leaders, and research on trends and best practices in tribal governance and development. From 2014 to 2021, he served as Vice President of Tribal Governance and Special Projects at the National Congress of American Indians. In this capacity, he led NCAI’s efforts to develop, coordinate, and share the knowledge, tools, and resources that Tribal Nations and leaders need to strengthen their governance systems and more effectively exercise their sovereignty. He also served as a policy lead on tribal workforce and economic development, and oversaw several NCAI projects, including its Ending “Indian” Mascots Initiative, Tribal Climate Action Initiative, Tribal Food Sovereignty Advancement Initiative, and Building Tribal Economies Initiative. From 2004 to 2014, Record served as Manager of Educational Resources for the Native Nations Institute for Leadership, Management, and Policy (NNI) at the University of Arizona. Dr. Record obtained his Ph.D. in American Indian Studies from the University of Arizona. Director | CDFI Fund | U.S. Department of the Treasury Ms. Pravina Raghavan began her tenure as the Director of the U.S. Department of the Treasury’s Community Development Financial Institutions Fund (CDFI Fund) on March 11, 2024. On her appointment, Noel Poyo, Treasury’s Deputy Assistant Secretary for Community and Economic Development said, “I am proud to introduce Director Raghavan to the CDFI Fund team and the broader community finance field. She is a seasoned leader in community and economic development with an impressive track record of overseeing billions of dollars in mission-oriented federal investments.“ Prior to the CDFI Fund, Director Raghavan served as the director of the Hollings Manufacturing Extension Partnership (MEP) located at the U.S. Department of Commerce’s National Institute of Standards and Technology (NIST). MEP helps small and medium-size U.S. manufacturers develop new products and customers, expand, and diversify markets, adopt new technology, and improve supply chains. Prior to MEP/NIST, she served as executive vice president in the Division of Small Business and Technology Development for Empire State Development, the New York State economic development agency. In that role, she led and managed a diverse portfolio including small business lending, bond guarantee, venture capital and technical assistance programs that provided billions of dollars in economic impact for the state; created and implemented the $100 million New York Forward Loan Fund and Empire State Digital resource for COVID-19 small business recovery; and designed and implemented the state’s $800 million COVID-19 Small Business Recovery Grant Program. She also served as deputy associate administrator of investment and innovation at the U.S. Small Business Administration (SBA) and was responsible for the Small Business Investment Companies Program, Small Business Innovation Research Program and High Growth Entrepreneur initiatives. She also served as district director for SBA’s New York District Office. Director Raghavan previously served as senior adviser to then-Deputy Secretary of Commerce Bruce H. Andrews. In that role, she worked on a large number of economic and operational issues across the department, including strategic planning and policy development on various topics including emergency management, economic development, international trade, weather, budget, contracts, staffing and technology development. Before joining the federal government, Director Raghavan was a vice president with MTV and BET Networks, a founder and owner of a global strategic advisory firm, and business development director for Misys PLC, one of the world’s largest banking software companies. She was also an associate at Broadview International, a London investment bank, and worked at AT&T in several finance and management roles, including her last five years as mergers and acquisitions director for Europe and Asia. Director Raghavan has an M.B.A. in finance from Seton Hall University and a B.S. in finance from the Pennsylvania State University. Member of Provincial Parliament | Kenora – Rainy River | Ontario Legislature | Minister of Indian Affairs The Honourable Greg Rickford was first elected to the Ontario Legislature as the MPP for Kenora — Rainy River in 2018 and re-elected in 2022. Over the past six years, he has been the Minister of Northern Development & Minister of Indigenous Affairs, Chairman of the Northern Ontario Heritage Fund Corporation Board, and Chairman of the Cabinet Committee for Economic and Resource Policy. Since June 2024, he has also served as Minister of First Nations Economic Reconciliation. Minister Rickford also served Premier Ford as the Minister of Energy, the Minister of Mines, and the Minister of Natural Resources & Forestry, in addition to his current portfolios. Minister Rickford’s academic and professional journey has been an interesting one: a lifelong learning plan focused on the pursuit of excellence in advocacy spanning three careers that include nursing, the practice of law, and politics. Minister Rickford has a Diploma in nursing from Mohawk College, a Bachelor of Science in Nursing from the University of Victoria, specializing in community health nursing. The Minister’s nursing career includes working in multiple specialized clinical settings in hospitals throughout North America and close to a decade working in northern isolated Indigenous communities across Canada. He has an MBA from Université of Laval as well as Bachelors of Common Law & Civil Law from McGill University. His law practice focused on Indigenous Matters including being a signatory to the Indian Residential School Agreement, Indigenous governance, economic and health opportunities. From 2008 to 2015 Minister Rickford, served as the federal Member of Parliament for Kenora. During that time, he served Prime Minister Harper as the Parliamentary Secretary for Aboriginal Affairs & Northern Development, Minister of State for Science & Technology, Minister responsible for the Federal Economic Development Initiative for Northern Ontario, and finally, Canada’s Minister of Natural Resources. That said, the most important job he has ever had is being a father to his two daughters. Principal Deputy Assistant Secretary – Indian Affairs | U.S. Department of the Interior Wizipan (Wee-zee-pan) Little Elk Garriott, an enrolled member of the Rosebud Sioux Tribe in South Dakota, is the Principal Deputy Assistant Secretary – Indian Affairs in the U.S. Department of the Interior. He serves as the first assistant and principal advisor to the Assistant Secretary – Indian Affairs in the development and interpretation of policies affecting Indian Affairs bureaus, offices, and programs. Prior to his appointment, Mr. Garriott served as chief executive officer from 2012 to 2021 of the Rosebud Economic Development Corporation, an ecosystem of Tribal organizations serving the Rosebud Indian Reservation. In this capacity, Mr. Garriott led and started businesses and community-based programs, including a Native language immersion school and 1,500-head buffalo herd. Mr. Garriott’s previous federal service included serving under the leadership of Assistant Secretary – Indian Affairs Larry Echo Hawk from 2009 to 2011. Mr. Garriott was born and raised on the Rosebud Indian Reservation where he attended St. Francis Indian School, a Bureau of Indian Affairs (now Bureau of Indian Education) facility. He has a Bachelor of Arts degree in American Studies from Yale University. Mr. Garriott received his Juris Doctor degree in 2008 from the University of Arizona’s James E. Rogers College. Co-Founder & CEO | Syncurrent Dhruv C. Patel is the CEO and Co-Founder of Syncurrent. Syncurrent is an AI first tech company innovating in the access to capital space for local governments across the United States. Most recently Dhruv led Syncurrent to capture a “first ever” partnership with the United States Department of Agriculture to host a pilot AI program in The State of Michigan. Dhruv is a subject matter expert in AI technology as it relates to government, a skilled entrepreneur with a blended skill set between organizational science, AI technology, govtech and public policy. Economic and Community Development Director | Penobscot Indian Nation EDUCATION Chief Financial and Economic Strategist | Native Americans in Philanthropy Dante Desiderio, a citizen of the Sappony, is currently serving as Chief Financial and Economic Strategist to Native Americans in Philanthropy. Prior to his financial and economic role, he recently led two of the largest organizations in Indian Country. Mr. Desiderio served as the Chief Executive Officer of the National Congress of American Indians (NCAI). He was hired with the challenge of creating financial stability for the organization while positioning the organization for generational growth. During his tenure, circumstances inspired him to take a lead role in guiding Indian Country through the pandemic. Prior to successfully serving as CEO for NCAI, Mr. Desiderio served as the Executive Director of the Native American Finance Officers Association (NAFOA). During his ten-year tenure at NAFOA, Mr. Desiderio restructured and grew the organization into a leading national tribal organization that represented tribal governments in building diverse and sustainable communities and economies. Mr. Desiderio has served on advisory boards for several universities, the Commonwealth of Virginia, and the Center for Indian Country Development at the Minneapolis Federal Reserve. Acting Deputy Administrator and Assistant Administrator | Office of International and Tribal Affairs | Environmental Protection Agency Jane Nishida is the Assistant Administrator for EPA’s Office of International and Tribal Affairs (OITA). She served as EPA’s Acting Administrator from January 20, 2021 to March 11, 2021, before the confirmation of current EPA Administrator Michael S. Regan. She was appointed by President Biden, confirmed by the U.S. Senate, and sworn in as OITA’s Assistant Administrator on September 24, 2021. President and CEO | Northwest Area Foundation Kevin spearheads Northwest Area Foundation’s efforts to stand alongside changemakers in its region of eight states and 76 Native Nations and fund work that leads to racial, social and economic justice. At the heart of this approach is NWAF’s longstanding commitment to target 40 percent of its giving to Native-led organizations. Other hallmarks of the Foundation’s work during his tenure include an expanded commitment to impact investing and an organization-wide drive to advance justice, equity, diversity, and inclusion (JEDI). Prior to joining NWAF, Kevin spent 13 years with the Charles Stewart Mott Foundation in Flint, MI. His nonprofit career began in the early 1990s with Food Gatherers, a community-based anti-hunger organization in Ann Arbor, MI. Kevin serves on the board of BoardSource, the national organization dedicated to excellence in nonprofit governance. He is past board chair of Philanthropy Northwest and Minnesota Council on Foundations. He lives in St. Paul, MN. Senior Project Manager | National Renewable Energy Laboratory (NREL) Jonathan Morgenstein joined the National Renewable Energy Laboratory (NREL) in July 2018. As a Senior Project Manager, his work has significantly focused on supporting under-resourced communities’ efforts to attain equitable clean energy access, and in particular access to affordable financing. He also leads NREL’s partnership development efforts with sub-federal jurisdictions in the mid-Atlantic. Additionally, Jonathan plays a leading role in U.S. Department of Energy (DOE)’s, NREL-led Community Power Accelerator (CPA) program scaling-up deployment of community-benefiting, distributed solar nationally, and particularly to the benefit of low-income and disadvantaged communities. Senior Director | Indigenous Futures Fund | Mission Driven Finance Ted has spent over 18 years in the Native CDFI Industry as a founding Executive Director on the Colville Indian Reservation. He is now the Sr. Director of the Indigenous Futures fund for Mission Driven Finance, Board Director for ATNI-EDC and OFN. Mr. Piccolo is working to aggregate capital into Indian Country by among other things, taking the program lead on implementing the Initiative for Inclusive Entrepreneurship as championed by the White House, instituting loan participations to move and unlock public capital through private funds. In these travels Ted is building working partnerships with Treasury, Philanthropy and banking institutions. Ted has led the charge in creating the unique private sector capital tool to help unleash Tribal SSBCI and public green energy dollars. Ted is a recovering serial entrepreneur, former sergeant in the U.S. Army and member of the Confederated Tribes of the Colville Reservation. Director of Tribal Energy Programs | Midwest Tribal Energy Resources Association (MTERA) Vanessa Farley is the Director of Tribal Energy Programs at the Midwest Tribal Energy Resources Association. Vanessa leads the MTERA Solar for All program to plan and deploy $62M of residential-serving solar projects within all 35 Midwest Tribal communities. In addition, she oversees the planning and implementation of all MTERA energy and energy efficiency programs. Vanessa is passionate about integrating clean energy within Tribal communities to bolster economic development, increase resilience, and strengthen Tribal sovereignty. An enrolled member of the Chippewa Cree Tribe of Rocky Boy Indians, Vanessa (she/her) holds a B.S. in Manufacturing Engineering from Stanford University. Affordable Lending Manager | Single-Family Acquisitions Division | Freddie Mac Dennis Smith is an Affordable Lending Manager within Mission and Community Engagement in the Freddie Mac Single-Family Acquisitions Division. He manages the affordable housing preservation and manufactured housing initiatives that support Freddie Mac’s underserved markets plan. A 25-year mortgage industry veteran, Mr. Smith joined Freddie Mac in 2015. He has served the industry as an underwriter and a process manager and in process improvement and product development. He managed the CRA and bond programs for a super-regional mortgage company. Freddie Mac makes home possible for millions of families and individuals by providing mortgage capital to lenders. Since our creation by Congress in 1970, we’ve made housing more accessible and affordable for homebuyers and renters in communities nationwide. We are building a better housing finance system for homebuyers, renters, lenders and taxpayers. Learn more at FreddieMac.com, Twitter @FreddieMac and Freddie Mac’s blog FreddieMac.com/blog. Co-Founder & CEO | Syncurrent