The Native CDFI Relending Demonstration program provides mortgage capital to NCDFIs through a 33-year loan at 1% interest rate with a 3-year payment deferral at loan onset. This capital can be used on tribal lands, Alaska Native Claims, and Hawaiian Homelands.

The funds must be used to provide direct loans to recipients. The minimum loan request is $500,000, and must be provided to individual loan recipients within 3 years of loan closing. Repayment will be annually and consist of both principal and interest, after the initial 3-year deferral.

This program is still a trial program and the application period ended August 2024.

Eligible Uses of NCDFI Relending Demonstration Funding

Purchase an Existing Property

Build a New Property

Repair/Renovate an Existing Property

Relocate a Home

Purchase Essential Household Equipment

Such as carpet, ovens, ranges, refrigerators, washers, dryers, heating and cooling systems if the equipment is conveyed with the dwelling

Purchase and

Prepare a Site

Including grading, foundation plantings, seeding or sod installation, trees, walks, fences and driveways

Must be in an

Eligible Rural Area

Not be used for income producing activities, and not have a market value in excess of the applicable area loan limit.

Who Can Apply?

- Certified Native CDFIs

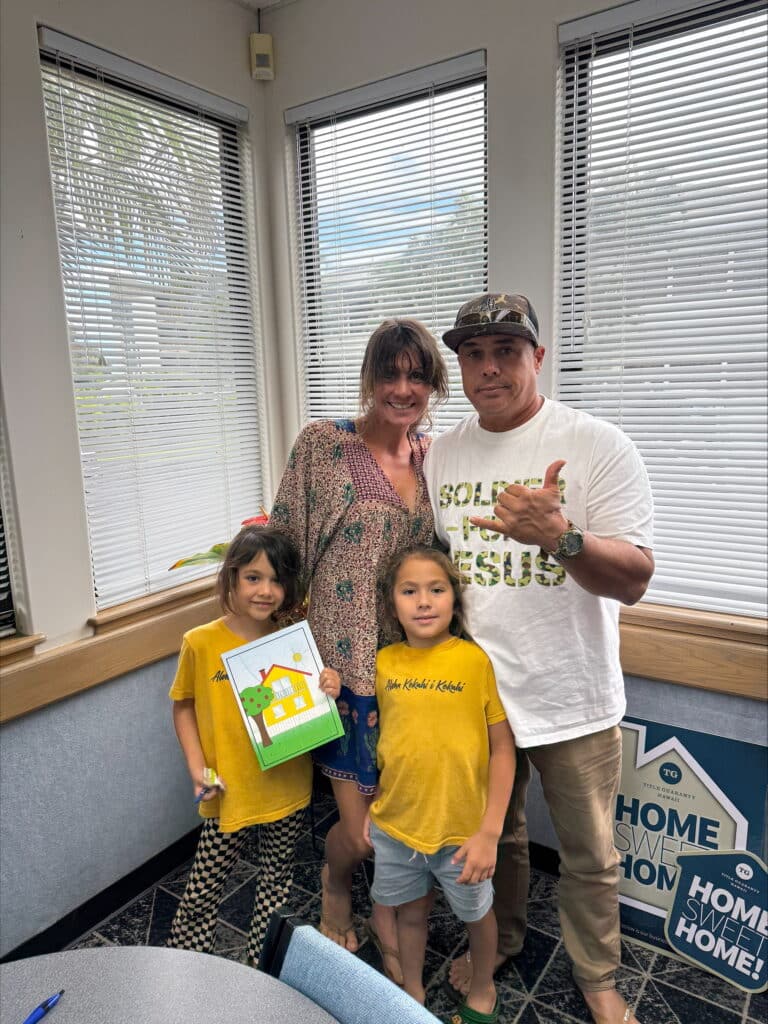

“Housing is the foundation for everything. It’s where community begins.”

Application Resources

Tools for a Successful Submission