Dr. Schmitt also is the owner of Schmitt Strategies, LLC, a woman- and minority-owned consulting business specializing in community and economic development. She has more than 30 years of experience working with tribal nations and organizations across the country. She has specialized skills and professional qualifications in education, community and economic development, and research and development. An enrolled member of the Turtle Mountain Band of Chippewa Indians, she has a PhD in Education from North Dakota State University and an MBA from the University of Mary.

In this insightful conversation with NCN, Barbara shares the unique nature of Native CDFIs as a change agent in Native communities, and the innovative services that BHCLF provides to its clients in the Rapid City area and beyond.

NCN: Greetings Dr. Schmitt, it’s good to have you with us today. Welcome.

Schmitt: Thank you. It’s good to be here.

NCN: Why do you do what you do? How and why did you come to lead the Black Hills Community Loan Fund (BHCLF)?

Schmitt: I just started in this role in March 2022. I’m fairly new here, but I do know the CDFI family. I worked previously as the economic development director at United Tribes Technical College, and right after that I started my own consulting business. I’ve always been passionate about economic development and working with Native communities. My dissertation actually was focused on what makes Native businesses tick and what makes them successful. I’m very passionate about the subject. So when I got the call from previous BHCLF Executive Director Onna LeBeau to come down and help out because she got a federal job in D.C. and they needed someone right away, I jumped at the chance. The plan was to only be here for three to four months, but it’s turning into much longer than that. I just can’t let it go. I’m so thrilled to be able to work with the Black Hills Community Loan Fund in Rapid City and work with the people that we do, the clients that we have in the community. It’s my passion and I just love working with Native people.

NCN: As you know, there are more than 70 federally certified Native CDFIs across the country and many more “emerging” CDFIs following in their footsteps. Why did Native communities feel it necessary to create CDFIs, and what fundamental role do they play?

Schmitt: We don’t get the recognition we deserve for the work we do. We’re left out of the loop of nonprofit organizations by federal agencies and are not provided the same opportunities as other nonprofits. The assistance we provide to our Native clientele is very important. We need to make sure we have our voice out there educating people on the successes of what we do and how unique we are in providing service to our Native communities. We’re unique in that we go the extra mile. We care about our clientele. As Native people, we are very family oriented, so we take care of one another and we’ll nurture our people to help them move forward.

For example, with home mortgages, many times our clientele are not able to qualify for commercial lending for one reason or another. So we’ll do credit builder loans with our clientele for six months to a year to get that their credit built up. From there, we take them through financial literacy or home buyer education. We’ll go through the sessions with them on exactly what it takes to buy a home. Then we’ll work with the lenders to help them get financing. We’re filling that gap.

“We’re unique in that we go the extra mile. We care about our clientele. As Native people, we are very family oriented, so we take care of one another and we’ll nurture our people to help them move forward.”

NCN: What do policymakers, philanthropy, and the general public who aren’t familiar with Native CDFIs need to understand about them and the difference they make?

Schmitt: In the federal world, the federal agencies are not as aware of Native CDFIs or CDFIs in general as they need to be. I wish they would provide a separate application for Native CDFIs for their funding sources, because right now we’re competing with nonprofit organizations, and we can’t compete with some of the big ones. A lot of the nonprofits get significant federal funds from the Economic Development Administration, Small Business Administration, HUD, and others that we don’t, so we need to educate them about how to fill those gaps and address the needs of Native CDFIs.

It’s also important for the financial world as well as philanthropists to understand that we don’t have access to a lot of those funds available out there. Black Hills Community Loan Fund is located in Rapid City. We’re not located on a reservation. Therefore, we don’t have that tribal support that a tribal administration would provide to their Native CDFI, so we have to count on the city or state for a lot of the funding that comes into our organization. So it’s all about educating these policymakers and saying, “You know what, here’s why we are important and here’s why we are making a difference out in your community.”

Schmitt: We’ve been in existence since 2007. We became a federally certified CDFI in 2017, which means we are eligible for additional funding from, for example, Oweesta Corporation. Right now, we are in the process of getting one of our staff members HUD Counseling certified, which would open other doors at HUD to get us additional funding.

We’re unique in the sense that because we’re located in Rapid City proper, we go out to our Native American population and provide them the services the city of Rapid City does not provide. We do credit builder loans, we do financial literacy assistance, we do homebuyer education to individuals on an as-needed basis. Every month, we will schedule sessions on each of our trainings and we usually try to do them in the evenings or on the weekends because a lot of people work during the week. We cater to our clients and go the extra mile for them. Because of where we are located and who we serve, we have to think outside of the box.

For example, when a client calls us and says, “I’m thinking of going into business,” staff will do an intake with them where we’ll just sit down with them and have a conversation. We’ll get a feel of where they’re at, how far they are in the game, and then we’ll work with them. We’ll decide whether they need the “Indianpreneurship” training, which is a specific entrepreneurship business training. They typically have good business ideas, but often they don’t know how to get that idea down on paper. We’re very hands on, and when it is it time for them to go to a bank to get financing to purchase or start a business, we make sure they are ready because we don’t want them to fail. We want them to be as prepared as possible. And then we continue our one-on-one with them. We have a staff member, Shannon, that will go out to them. There is a coffee shop in Hermosa, which is about 30 miles from Rapid City, and she’ll meet with them there twice a week to help them move them forward, get their businesses all set up, and make sure they have everything they need, like understanding how to do inventory. She also goes out to Sturgis. As I mentioned, we view them as our family and we will go the extra mile for them.

NCN: One of the opportunities you offer is a matched savings account. Tell us how this works, and how has it benefitted those community members who have participated?

Schmitt: That has been one of the most successful products we provide. How it works is we have a 4-to-1 match so when they come in, we tell them if you save $1,000, we will match it at four to one, meaning we will provide them $4,000. Once they’re done saving that $1,000, we have them work with a realtor. We do a lot of Habitat for Humanity homes, and once they have identified their house, then they will go to the bank and say, “I have $5,000 for a down payment.” That might not seem very much, but it will help with closing costs. It’ll help with any of the gap finance debt financing that they need. Any little thing will help. Unfortunately, we’ve had to scramble to raise funds for that program. People often just don’t give out money for those individual accounts, so we’ve had to be very creative in contacting some of our foundation partners to ask for $20,000 or even $50,000 to support it. The demand pipeline right now is a lot more than what we currently have, but we’re working on it.

NCN: During the height of the COVID 19-pandemic, your CDFI responded by launching its “Empowerment Package” initiative to assist local Native artists in weathering the economic impacts of the pandemic and strengthen their businesses. Can you tell us more about this initiative and how it helped?

Schmitt: Rapid City has a lot of Native artists located in the city proper. When COVID hit, it was really hard for these artists to sell their wares. So we came in and said, “We’re going to provide you financial resources to help you get through this pandemic. We provided emergency utility assistance, rental assistance, childcare assistance, anything to help them. Being an artist is really hard to sustain. If they are not able to have customers come to look at their wares, they’re not going to make the sales. So we helped them sell their wares online. This initiative was very successful.

NCN: BHCLF has helped a great number of people. Is there an individual client success story that really sticks out to you, that really inspires you?

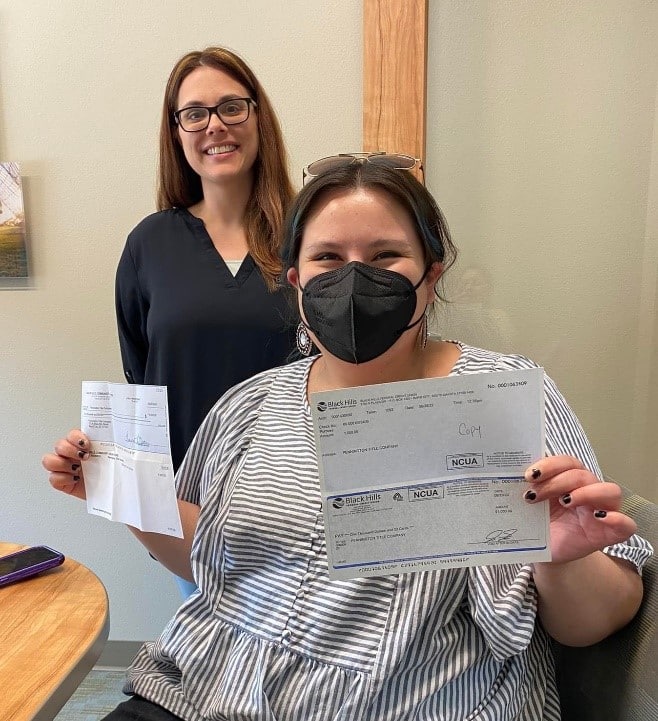

Schmitt: Tosa Two Heart is one of our matched savings program participants. She just bought her first home in June, and it was through the 4-to-1 match that she was able to do that. If we weren’t able to provide her that assistance, she wouldn’t have been successful in her quest to become a homeowner. She was so thankful, as are all of those we have helped in the past. Knowing her and the effort she made was really heartwarming, because it takes dedication from the clientele as well. They have to have enough passion to say, “Okay, I’m going to do this. I’m going to have the dedication to raise this money myself.” Tosa is a success story – she is making sure her family is taken care of. I know her personally and I know the background she comes from, so it makes her story all the more extraordinary.

NCN: From your perspective, what do Native CDFIs like yours need to realize their full potential? What support do they need to achieve their missions and maximize their impact? Is it policy? Is it funding? Is it capacity? Is it some combination of the above?

Schmitt: Money. For us to be completely self-sufficient, the federal agencies need to recognize the needs that we have out here, and the community here needs to recognize that, too. The community of Rapid City needs to understand that BHCLF provides back to them through the products and services we provide. We don’t just help Native people – we can help low- and moderate-income families as well that are not Native. But for us to move forward, we need to have that buy-in and support from federal and state agencies and the local community here.

To learn more about Black Hills Community Loan Fund, please click here.