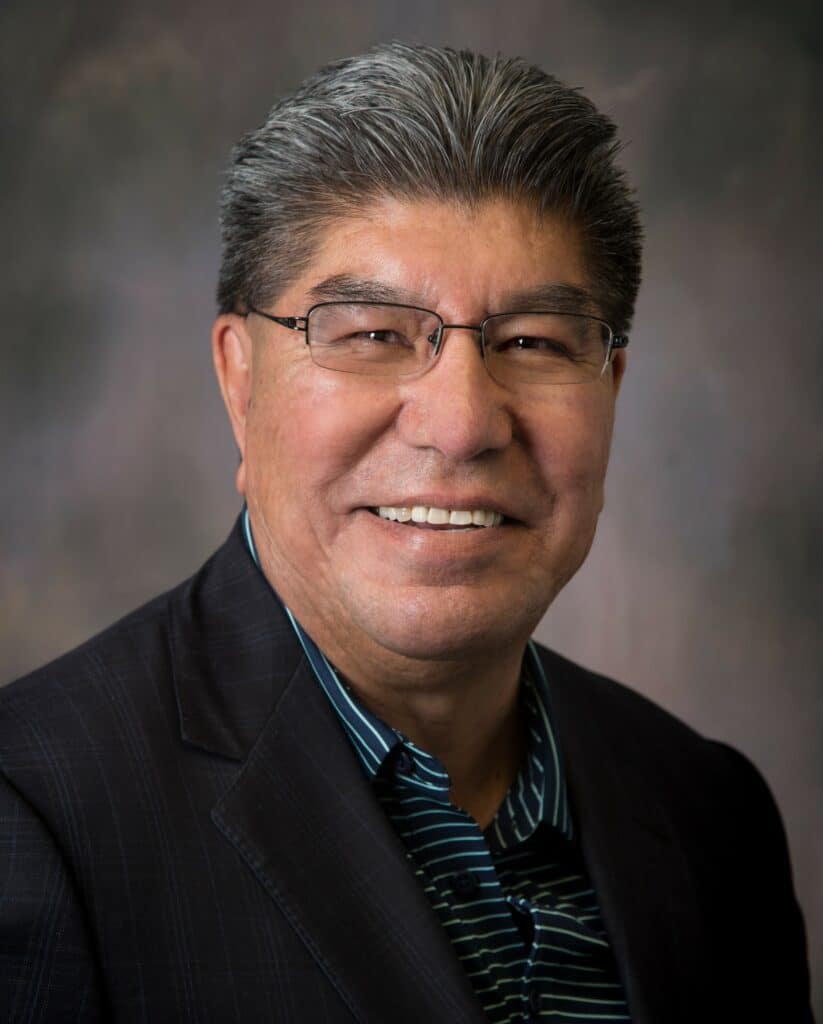

In this latest edition of “Difference Makers,” NCN sits down with Leonard Smith, who serves as Chief Executive Officer and founder of the Native American Development Corporation (NADC), a federally certified Native CDFI headquartered in Billings, Montana. A regional hub for Native-owned businesses, NADC provides affordable and flexible financing, technical assistance, a marketing platform, and other services to existing and aspiring Native entrepreneurs as the centerpiece of its effort to foster Native communities’ ability to achieve economic and social stability.

An Assiniboine & Sioux tribal member of the Fort Peck Tribes, Leonard also serves as the Director of the NADC-affiliated Billings Urban Indian Health & Wellness Center as well as a board member for the Montana Community Foundation. Among his many previous roles, he served as a Deputy District Director for Business Development with the U.S. Small Business Administration.

In this insightful conversation with NCN, Leonard shares how NADC has become a sustainability hub for Native nations and entrepreneurs in the region it serves, and also explains how the organization supports the growth of Native-owned businesses by helping them bring their goods to market.

NCN: Greetings Leonard, it’s good to have you with us today. Welcome.

Smith: Thank you. I am glad to participate.

NCN: So why do you do what you do? How did leading the Native American Development Corporation become your life’s calling?

Smith: While I was in college, I got very involved in a lot of the movement for Indians in general. Everybody was very aware of that for Native Americans at the time, and I got caught up in that. It led me to looking at the needs of ourselves as native people to get our pride back and move on, and a lot of sovereignty-related issues and how we might be able to help us help ourselves. What did we need to do? We needed leaders. We needed education. We needed to start reaching out to develop those programs and services. So that’s where I got my start. I went to an Indian center in an urban area and I became the director of that. After that, things just started coming to me. One thing led to another – program after program and even some private sector experience with the Small Business Administration (SBA), which opened my eyes to some other areas related to business and economic development and sustainability – Everything we needed to be sustainable so we just didn’t rely strictly on government funds. To do that, you needed access to capital. A lot of projects on reservations sit on shelves because there’s no capital at all. If you’re not a casino operation or something of that nature, capital is very hard to come by, especially on reservations because the environment isn’t conducive to that. You’ve got to deal with trust land and banks are skeptical about making loans on reservations.

I also realized very quickly that although reservations provide a lot of income to the states they reside in, people don’t think of them as contributors to the economy of the state. Most of the income on reservations doesn’t get spent on the reservations. It gets spent in the surrounding communities

“We need the federal government and the private banking institutions to take more notice of us and work with us to provide capital to the reservations. It’s a constant education program. They need to realize we are filling the gap and we are a path to making Indian Country sustainable…The reservations could be an economic force, and some reservations are already doing that – the ones that have access to capital.”

NADC works on these issues, but we also do other things besides just the CDFI. We basically bootstrap a lot of other services and help them get started. We’ve expanded our services from Montana to North Dakota, South Dakota, and Wyoming in government procurement. All of our programs are all related to helping individuals and tribes develop businesses and become sustainable. We’ve always had to be the trailblazer to get something started. The CDFI is so very important for individuals to get established. When we started out, we did a lot of work with individual Native Americans, but we’ve since expanded and are trying to expand even more into larger projects – not just micro anymore, we’re talking about macro with both tribal and now urban. There’s a large urban population that we started working with on a contract with the Indian Health Service for an urban health clinic. We’ve always been about helping Native Americans.

NCN: As you know, there are currently 64 federally certified Native CDFIs across the country and many more “emerging” CDFIs following in their footsteps. Why did Native communities feel it necessary to create CDFIs, and what fundamental role do they play?

Smith: Capital is hard to come by on reservations, and banks are skeptical about providing it. Also, often there isn’t anything in place to protect investors. And there’s such a history of bad relationships between the tribes and outside entities – a lot of distrust there. CDFIs are filling a gap there. They can provide capital with the help of the Department of Treasury and some small grants they provide, and they can structure other sources through partnerships or working closely with other federal resources. They’re a liaison between capital resources off the reservation and potential loan clients on the reservation. They can take on the more risky part of the relationship.

NCN: What do policymakers, philanthropy, banking institutions, and the general public who aren’t familiar with Native CDFIs need to understand about them and the difference they make?

Smith: It’s a constant educational process. As we develop partnerships off the reservation, that’s a big part of what we do – educating the investor, the potential partner. A lot of times, we play a liaison role in getting those agreements in place and educating both sides about how to best do that. Especially in the last couple of years, with COVID relief, there’s been a lot of opportunities with the federal government. The way I look at it, this maybe the last opportunity like this to really get something going, so we’re trying to make the most of it. But like I said, there’s distrust there. Our tribes in our area, it takes them just a little bit longer to build that trust. But it is progressing. People are starting to understand and we’re playing a role. In the outside communities, too, we’re asked to participate on advisory boards and those kinds of things. It’s definitely an educational process, and it’s a long process, but it is working.

Smith: Everything we do is related to our capacity, which is our strong background in entrepreneurship. We believe that sustainability is a crucial part of development in Indian country – that it makes a lasting impact. We learned a while back that the people on reservations don’t have so much time. They’ve got a tough job and they only have so much time to make an impact. But making an impact is a long process. To do it, you need some kind of stability. We’re able to be take a more long-term approach. We can be consistent in our message and development strategy. We have found after working in Indian Country for a lot of years is that we just need to do it. Once it’s done, people will see that, “Yeah, it works. It works – so we should probably do it, too. In the last five years, we’ve taken that approach – we needed to build our own sustainability to be a resource to Indian Country so we have the capacity to build these successful projects.

NCN: NADC hosts one of the nation’s six Native Procurement Technical Assistance Centers, commonly known as PTACs. Why did NADC take this on, and how is your PTAC strengthening and growing Native businesses in the four-state region it serves?

Smith: I’m the founder of this organization, and then I left for a while and went back to my own reservation. I was the CEO of a manufacturing operation and then I went to SBA for a period of time. When I came back to this organization and started moving it forward again, one of the things I noticed is a lot of government contracting entities on the reservations in Montana didn’t feel they weren’t getting the direct, hands-on technical expertise they needed. At that time, the PTACs were all located with one organization, which is a very good organization, but I think the whole United States was just too much ground for them to cover. I started working on figuring out a way to get more of that technical assistance to be local. The opportunity came up for us to bid on it, and we got the contract for that purpose. Since we’ve started the PTAC, we’ve done millions and millions of dollars worth of contracts to tribal enterprises and more recently a lot of individual entrepreneurs as well. So it’s having an impact.

NCN: In 2019, NADC launched an e-commerce platform designed to help Native vendors sell more of their goods. How does this platform work, and in what ways does it benefit Native vendors who feature their goods on the platform?

Smith: We did a lot of research to set that up and gave it its own name, “TRIIA,” and its own website. It is working with Native artists in Montana, and now we’re getting interest from artists in other states as well. We’re really working to market their work and develop ways to help them sell their articles not only here in the United States, but also outside of the United States. We’re providing technical assistance to them where they’re having some success now.

Some of them are selling their artwork at much higher prices. Many had been selling their artwork at a low, low rate just to get money. We’re creating a market for them as artists.

NCN: In a momentous step forward in its growth, NADC recently purchased the Shrine Auditorium, a Billings landmark. Why did NADC take this step, and how will NADC utilize this facility to expand its difference-making work?

Smith: That really came out of our expansion needs for our urban health clinic. It is serving the urban Native American population, which we know it’s well over 10,000. A lot of people come to Billings from the surrounding reservations. Quality health care has always been a real need, and our people deserve quality health care. We leased a space from one of the hospitals here in Billings, but we’ve outgrown that. So we bought the Shrine, and we’re renovating it to turn it into a health and wellness center. We’re going to be targeting the youth and elderly to help make them healthy again with food, exercise, and services that we have available. It has five acres with it, so we’re going to build on that five acres probably a new clinic. We’re expanding into other areas of healthcare, too, with a medically assisted treatment center and also recovery residences for opiate abuse. We also will be housing the Seventh Generation Indian center there as well, and also will host cultural activities there. We have a huge gym there, so we’ll probably be putting on basketball events, too. It’s also a place where we can help the non-Native community learn about Natives.

NCN: NADC has helped a great number of Native people over its 25-plus years in operation. Is there a particular success story that really inspires you that you would like to share?

Smith: There’s quite a few our CDFI has supported. One that comes to mind is a propane business on one reservation that now has expanded to outside the reservation and is now providing those same services to other reservations in our area. That’s an entrepreneur whose market is really thriving. We also work on a lot of big projects on our reservations such as renewable energy projects.

NCN: From your perspective, what do Native CDFIs like NADC need to realize their full potential? What types of support do they need to achieve their missions and maximize their impact?

Smith: We need the federal government and the private banking institutions to take more notice of us and work with us to provide capital to the reservations. It’s a constant education program. They need to realize we are filling the gap and we are a path to making Indian Country sustainable. But there’s profit in that, too. There was a study conducted years back on the amount of leakage – it’s a lot of money that comes from the reservations to the outside communities. The reservations could be an economic force, and some reservations are already doing that – the ones that have access to capital. Our tribes don’t have access to all of that capital, so we’ve got to be a little bit more creative to get that capital. We are learning about and using a lot of private sector techniques to get access to that capital and working to make that capital available. But we have to get Indian Country shovel ready. There’s capital, but they’ve got to be shovel ready.

To learn more about the Native American Development Corporation, please click here.