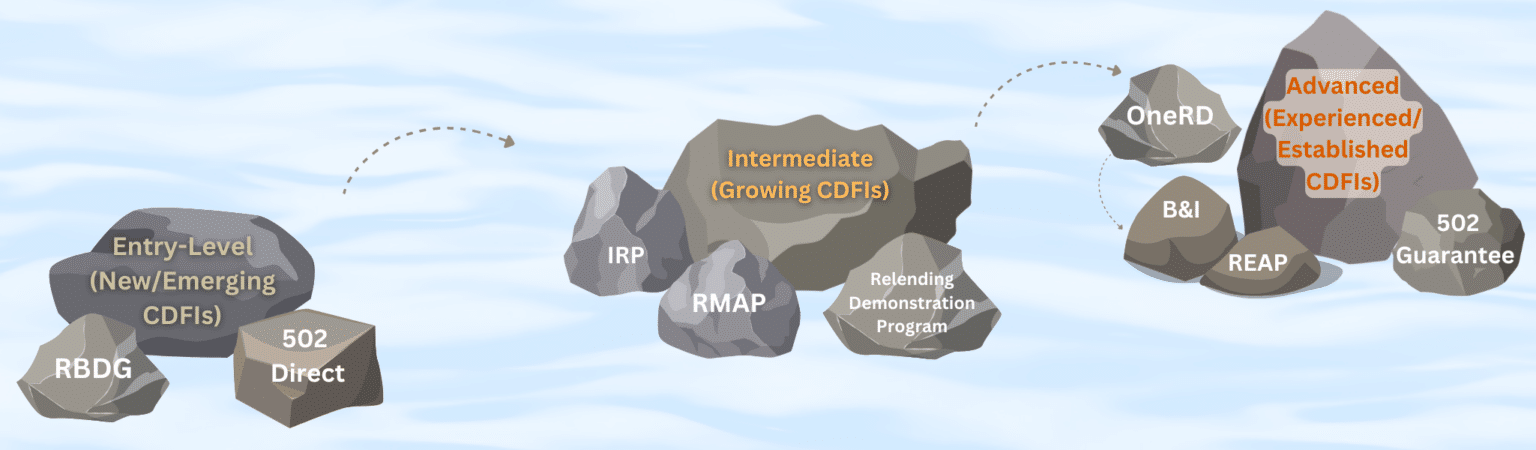

Rural Business Development Grant (RBDG)

Intermediary Relending Program (IRP)

Rural Microentrepreneurial Assistance Program (RMAP)

Business and Industry (B&I) Loan Guarantee Program

Funding Structure

Grant

Loan

Both

Loan

Maximum Term

30 years

20 years

?

Funding Frequency

Annually

Quarterly

Quarterly

Year-round

Interest Rate

Fixed 1%

Fixed

Indirect cost rates

Match Requirement

?

15%

?

Eligible Projects

Working capital

Debt refinancing

Improving real estate

Establish new business

Establish and support microlending programs.

To purchase or develop land

To purchase equipment

For pollution control and abatement

For transportation services

Professional fees, ie, architects, lawyers, engineers, accountants.

Towards the building of hotels, motels, convention centers

For educational institutions

For aquaculture-based rural small business

To establish revolving lines of credit

Technical assistance and training

Feasibility studies and business plans

Rural business incubators