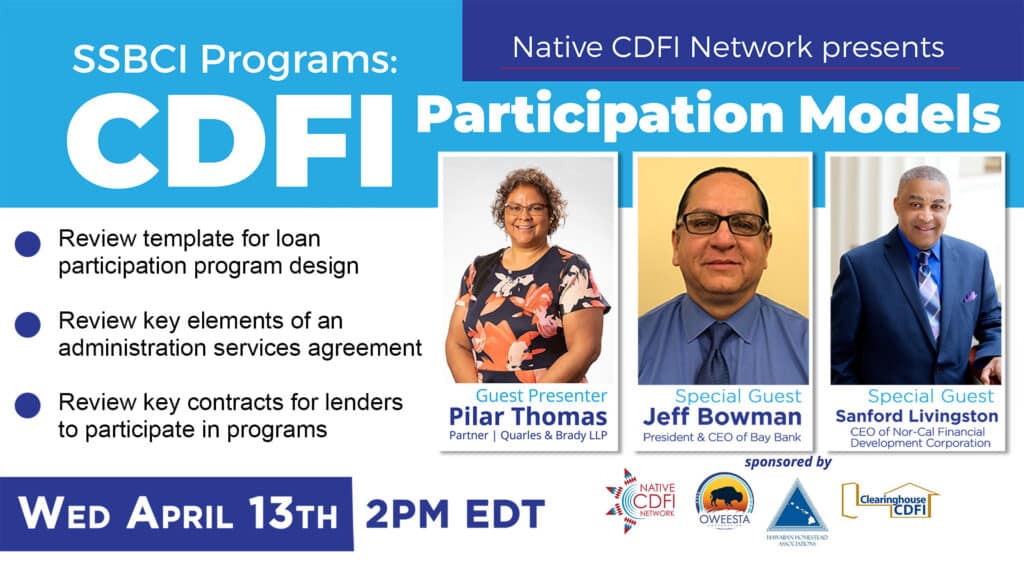

Jeff Bowman, President and CEO of Bay Bank in Green Bay, WI, began the meeting by sharing practical advice on rollout of SSBCI from both a banking and tribal perspective. Jeff also shared tips to prepare financials for the SSBCI application along with sample spreadsheets. Jeff is active with several organizations that facilitate economic and small business development.

Pilar Thomas, Native attorney and SSBCI expert, followed with detailed information on the program and advice for developing the narrative portion of the SSBCI application. She shared two template agreements that tribal governments and Native CDFIs can use for partnering to access the technical assistance and capital deployment funding the SSBCI program offers.

Sanford Livingston II, CEO of Nor-Cal Financial Development Corporation, closed the webinar with a few detailed remarks and insights into SSBCI and opportunities in the state of California. In addition to overseeing the administration, programs and development plan of Nor-Cal FDC, Sanford has overall strategic and operational responsibility for staff, programs, expansion, and execution of its mission.

Download presentations and resource materials:

- Pilar Thomas’ Presentation – Tribal Small Business Credit Initiative: Program Agreements

- Jeff Bowman’s Presentation – Loan Participation Program using SSBCI Funds

- Sample OCSP Tables Spreadsheet

- SSBCI Loan Activity Spreadsheet

View the session video in its entirety below.