In this latest edition of “Difference Makers,” NCN sits down with Tamra Marlowe, who serves as Executive Director of Chehalis Tribal Loan Fund (CTLF), a federally certified Native CDFI based in Oakville, Washington. Established in 2007, CTLF serves the Chehalis Tribal people and surrounding community through multiple forms of assistance and support, including financial education, business development training and resources, home and auto buyer’s workshops, and asset building through loans for small businesses, debt consolidation, credit building, home improvement loans, and rental assistance.

In this latest edition of “Difference Makers,” NCN sits down with Colleen Steele, who serves as Executive Director of Mazaska Owecaso Otipi Financial, a federally certified Native CDFI located on the Pine Ridge Indian Reservation in South Dakota. Serving members of the Oglala Sioux Tribe living on or near Pine Ridge as well as enrolled members of other federally recognized tribes in South Dakota, Mazaska’s mission is to create safe and affordable housing opportunities by providing loans, training, and financial insight to empower Native people to build assets and create wealth.

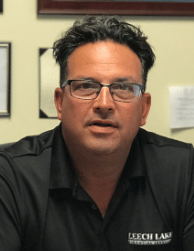

In this latest edition of “Difference Makers,” NCN sits down with Robert Aitken, who serves as Executive Director of Leech Lake Financial Services (LLFS), a federally certified Native CDFI based in Bemidji, Minnesota. Leech Lake promotes the economic wellbeing of Leech Lake Band of Ojibwe members and their families by providing safe and affordable financial products and a growing array of trainings on credit building and other financial topics.

In this latest edition of “Difference Makers,” NCN sits down with Jonathan Zurek, who serves as Executive Director of the Seneca Nation of Indians Economic Development Company (SNIEDC), a federally certified Native CDFI based in Salamanca, New York. Chartered in 1993 by the Seneca Nation of Indians Tribal Council, SNIEDC is a specialized financial institution that works in market niches that are underserved by traditional financial institutions.

In this latest edition of “Difference Makers,” NCN sits down with Cindy Logsdon, who serves as CEO and Executive Director of the Citizen Potawatomi Community Development Corporation (CPCDC), a federally certified Native CDFI based in Shawnee, Oklahoma. Chartered by the Citizen Potawatomi Nation (CPN), CPCDC provides capital and technical assistance for projects that create a healthy tribal economy through a commercial loan program designed to help Native businesses become more competitive and profitable. CPCDC also assists tribal members who lack financial resources and readiness with business development and planning, financial education, financial management services, marketing, and contracting.

In this latest edition of “Difference Makers,” NCN sits down with Alissa Charley, who serves as Executive Director of the Hopi Credit Association (HCA), a federally certified Native CDFI that serves enrolled members of the Hopi Tribe in northeastern Arizona. Established in 1952 by a group of Hopi ranchers as a financial resource, HCA’s mission is “to enhance the quality of life by providing lending, financial education, and training opportunities for our Hopi Senom to become informed consumers.”

In this latest edition of “Difference Makers,” NCN sits down with Rollin Wood, who serves as Executive Director of the Native Partnership for Housing, Inc. (NPH), a federally certified Native CDFI in Gallup, New Mexico. The Partnership serves the housing and homeownership needs of Native and also non-Native clients in the Four Corners region in both remote and urban areas. Offering a full range of services, it provides financial education and counseling for home buyers, flexible and affordable mortgage lending products, and quality design, build, and remodel services.

In this latest edition of “Difference Makers,” NCN sits down with Rjay Brunkow, who serves as CEO of Indian Land Capital Company (ILCC), which is based in Little Canada, Minnesota. A federally certified Native CDFI, ILCC provides alternative loan options to Native nations for land acquisition projects. Creating customized, flexible loan packages that suit the specific needs of Native nations and the unique circumstances of their land purchases, ILCC also works with its owner, the Indian Land Tenure Foundation, to provide technical assistance to Native nations as they develop and execute their land acquisition strategies.

In this latest edition of “Difference Makers,” NCN sits down with Mary Miner, who serves as Vice President of Community Development for Alaska Growth Capital BIDCO, Inc., in Anchorage, Alaska. Alaska Growth Capital (AGC) is a federally certified Native CDFI that was founded in 1997 as Alaska’s first Business and Industrial Development Corporation (BIDCO). It was created to promote economic development and job creation by providing loans, investments, and management assistance to businesses, and is a leading provider of business loans utilizing programs offered by the U.S. Small Business Administration and the U.S. Department of Agriculture.

In this latest edition of “Difference Makers,” NCN sits down with Jeff Tickle, who serves as General Manager of Cook Inlet Lending Center, Inc. (CILC) in Anchorage, Alaska. Formerly known as NaQenq’a, CILC is a federally certified Native CDFI that was created in 2001 as a social enterprise of the Cook Inlet Housing Authority to address the need for affordable home financing and development services in the Cook Inlet Region of Alaska. It has since grown to offer small business loan products to Native entrepreneurs.