NCN CEO Pete Upton Urges Policymakers to Protect Native CDFI Funding in New Op-Ed

In a compelling op-ed published this week in Tribal Business News, Pete Upton, CEO of the Native CDFI Network (NCN), calls on federal policymakers to reaffirm their commitment to Native Community Development Financial Institutions (CDFIs) by maintaining — and growing — critical investments.

Read MoreNCN Shares Survey Results with Congress Documenting Impacts of Planned and Proposed NACA Funding Cuts on Native CDFIs and the Native Communities They Serve

Today, NCN shared with Congressional leaders and their staff a summary document featuring a representative sampling of the survey responses NCN received from Native CDFI leaders.

Read MoreNCN Remains Ready to Launch When CCIA Program Is Reinstated

On June 18, a federal judge ruled that the Environmental Protection Agency acted unlawfully when it terminated environmental justice grants awarded through the Inflation Reduction Act.

Read MoreUpcoming NCN Live: Navigating USDA’s Single Family Housing Programs

The Native CDFI Network invites you to a special NCN Live webinar featuring Brian Hudson, Finance and Loan Analyst for Special Programs and Initiatives in the Single-Family Housing Direct Loan Division at USDA Rural Development.

Read MoreNCN Signs On to Letter Urging Senate to Protect Tribal Energy Incentives

The Native CDFI Network is proud to join Tribal Nations, inter-tribal organizations, and Native-serving nonprofits in signing a joint letter to Senate leadership urging continued support for Tribal energy self-determination.

Read MoreNCN and 53 Native CDFIs/Partners Submit Joint Letter Opposing Administration’s Plan to Withhold FY 2025 Funding for the CDFI Fund’s Native CDFI Assistance (NACA) Program

The Native CDFI Network (NCN) joined together with 53 Native CDFIs and key Indian Country partners to submit a joint letter to Congressional leaders and key Administration officials protesting the Trump Administration’s plan to withhold a total of $24 million in funding for qualified Native CDFIs (a reduction of 86%).

Read MoreSave the Date for NCN’s Midwest Regional Event in Green Bay, WI!

The Native CDFI Network (NCN), in partnership with the Wisconsin Indigenous Housing & Economic Development Corporation (WIHEDC), is pleased to invite you to our Midwest Regional Event on August 7–8, 2025 at the Oneida Casino Hotel in Green Bay, Wisconsin.

Read MoreURGENT: Calling on All Native CDFIs and Partners to Oppose Administration’s Plan to Withhold FY 2025 Funding for the CDFI Fund’s Native CDFI Assistance (NACA) Program

The Native CDFI Network (NCN) recently learned that the Trump Administration intends to obligate only $4 million of the $28 million in federal funding that Congress recently appropriated for the CDFI Fund’s Native CDFI Assistance (NACA) Program for FY 2025, meaning it plans to withhold a total of $24 million in funding for...

Read MorePresident Trump Releases Detailed FY 2026 Budget Proposal; Treasury Budget Eliminates NACA Program

Over the weekend, most federal agencies released detailed FY 2026 budget justifications pursuant to the basic parameters President Trump included in his Discretionary Budget Request overview in early May. As expected, the U.S. Department of the Treasury’s Congressional Justification features a 90% reduction in funding for the CDFI Fund from...

Read MoreNCN Invites Native CDFIs and Partners to Join Sign-On Letter to U.S. Senate Seeking to Protect Tribal Energy Development in Reconciliation Bill

The Native CDFI Network (NCN) invites all Native CDFIs and other key partners to sign on to a joint letter to U.S. Senate leadership regarding the Senate’s pending deliberations of the One Big Beautiful Bill Act (H.R.1),

Read MoreNCN Live: Exploring Syncurrent – A Digital Platform to Fast Track Funding Opportunities for Federally Recognized Tribes

Join us for an upcoming NCN Live webinar featuring Syncurrent, an AI-driven platform designed to streamline the process of identifying and accessing federal and state funding opportunities for Tribal Nations and local governments.

Read MoreNCN Applauds Native CDFI Inclusion at NCAI & IGA 2025 Legislative Summit

NCN extends its appreciation to the National Congress of American Indians (NCAI) and the Indian Gaming Association (IGA) for including NCN in a powerful two-days of tribal policy briefings and engagement May 13-14 in Washington, D.C.

Read MoreNew NCN Leadership Institute Training Series Launches in June

NCN is excited to announce its summer training series Risk-Proof Your Funding: Compliance Tactics for Native CDFIs.

Read MoreNCN Delivers Letter to Congress Urging Protection of NACA Program Funding in the FY 2026 Appropriations Process

Today, the Native CDFI Network (NCN) and 66 Native CDFIs and other key partners delivered a powerful message to Capitol Hill, calling on Congress to reject the proposed defunding of the Native American CDFI Assistance (NACA) Program in President Trump’s FY 2026 Discretionary Budget Request.

Read MoreStand with NCN to Support our Native Communities and Protect the NACA Program

To ensure that Native CDFIs continue receiving the critical support they need, we must speak up now. To support your outreach, we’ve prepared a message template you can download, personalize, and send directly to your representatives.

Read MoreNow Available: NCN’s Q1 2025 Impact Report

We’re proud to share NCN’s Quarter 1 Impact Report — a powerful reflection of the momentum, unity, and determination of Native CDFIs across the country.

Read MoreNCN CEO Participates in U.S. Treasury Financial Literacy Roundtable

Pete Upton, CEO of the Native CDFI Network (NCN), participated in a Financial Literacy Roundtable hosted by the U.S. Department of the Treasury on April 30, 2025.

Read MoreNative CDFI Network Meets with Federal Leaders, Reaffirms Support for Native Programs Amid Budget Threats

Members of the Native CDFI Network (NCN) Board of Directors met in Washington, D.C. with CDFI Fund Director Pravina Raghavan, Clint Hastings, and Fatima Abbas, Director of the Office of Tribal and Native Affairs at the U.S. Department of the Treasury.

Read MoreNCN ACTION ALERT: President Trump Releases FY 2026 Budget Proposal Featuring Near-Total Elimination of Funding for CDFI Fund

Today, the Trump Administration released a high-level overview of its FY 2026 Discretionary Budget Request, or “skinny budget,” which features a 90% reduction in funding for the CDFI Fund from its FY 2025 funding level of $324 million to just $33 million.

Read MorePamela Boivin Unanimously Elected Chair of WEDC Board of Directors

The Native CDFI Network (NCN) is proud to announce and celebrate the election of Pamela Boivin as the newly elected Chair of the Wisconsin Economic Development Corporation (WEDC) Board of Directors!

Read MoreNCN Live Webinar | The Future of CRA: What’s at Stake for Native CDFIs?

This webinar will provide critical updates on the status and future of the revised Community Reinvestment Act (CRA) rule, including what potential changes or a full rescission could mean for Native CDFIs and other mission-driven lenders.

Read MoreHelp Strengthen the Native CDFI Industry: Complete the Annual CDFI Survey

The Native CDFI Network (NCN) is once again partnering with the Federal Reserve to distribute the annual CDFI survey. We encourage all Native CDFIs to participate to ensure our industry is well-represented in the data.

Read MoreNative CDFI Network CEO Pete Upton Elected to Clearinghouse CDFI Board of Directors

The Native CDFI Network (NCN) is proud to announce that its CEO, Pete Upton, has been elected to the Board of Directors of Clearinghouse Community Development Financial Institution (Clearinghouse CDFI) during its Annual Shareholders Meeting held on March 27, 2025.

Read MoreNCN Responds to GGRF Claims, Reaffirms Commitment to Native Clean Energy Investment

Despite recent challenges, NCN remains steadfast in our commitment to work collaboratively with the EPA and all stakeholders to meet our shared goals.

Read MoreNearly 60 Native CDFIs and Partners Join NCN Sign-on Letter Requesting Congress Fund the CDFI Fund’s Native American CDFI Assistance (NACA) Program at $50 Million for FY 2026

Late last week, the Native CDFI Network (NCN) and 59 co-signatory Native CDFIs and Indian Country partners sent a joint letter to Congress requesting $50 million in appropriations for the CDFI Fund’s NACA Program for FY 2026.

Read MoreNCN Invites Native CDFIs and Partners to Join Sign-on Letter Requesting $50 Million for CDFI Fund’s Native American CDFI Assistance (NACA) Program for FY 2026

The Native CDFI Network invites all Native CDFIs as well as other key Indian Country stakeholder and partner organizations to join its sign-on letter to Congressional leadership requesting a $50 million appropriation for the CDFI Fund’s Native American CDFI Assistance (NACA) Program for FY 2026

Read MoreMore than 80 Native CDFIs and Partners Join NCN-Oweesta Sign-on Letter Opposing Trump Executive Order Targeting CDFI Fund; Templates for Individual Letters Now Available

The Native CDFI Network (NCN), Oweesta Corporation, and 84 co-signatory Native CDFIs and Indian Country partners sent a joint letter to top Treasury officials and key members of Congress expressing their shared concern regarding the Executive Order “Continuing the Reduction of the Federal Bureaucracy” issued by President Trump last Friday and its potentially grave...

Read MoreNCN, Oweesta Invite Native CDFIs and Key Partners to Join Sign-on Letter Opposing Trump Executive Order Targeting the CDFI Fund

The Native CDFI Network (NCN) and Oweesta Corporation invite all Native CDFIs and other key Indian Country stakeholder and partner organizations to join their sign-on letter to Treasury officials and Congressional leadership opposing President Trump’s executive order (EO) targeting the CDFI Fund that was issued on Friday.

Read MorePresident Trump Issues Executive Order Directly Targeting the CDFI Fund; NCN Calls on All Native CDFIs and Their Partners to Mobilize in Response

The Native CDFI Network (NCN) calls on all Native CDFIs and their partners to express their concern about the potential impacts of this executive order on the NACA Program and the CDFI Fund’s ability to otherwise support Native CDFIs by immediately contacting their Congressional delegations.

Read MoreNCN Live: Examining Trump’s Executive Order on Federal Bureaucracy Reduction

Join the Native CDFI Network (NCN) for an in-depth discussion on President Trump's latest Executive Order, "Continuing the Reduction of the Federal Bureaucracy."

Read MoreNCN’s Native Partnership Gathering Kicks Off California Regional Meeting, Expanding Native CDFI Efforts

NCN's Native Partnership Gathering marked a significant step in the creation of more Native CDFIs in California and Nevada, bringing together tribal leaders, economic development professionals, and community advocates to highlight the ongoing work of Native CDFIs in the region.

Read MoreACTION ALERT: NCN Seeks Input from Native CDFIs about the Impacts of Delaying, Withholding, Reducing, or Eliminating Federal Funds on Their Ability to Serve Native Communities

The Native CDFI Network (NCN) invites all Native CDFIs to respond to a short survey about current efforts by the Trump Administration and emerging efforts by some in Congress to delay, withhold, reduce, or eliminate the federal funding upon which Native CDFIs rely.

Read MoreNCN and 68 Co-Signatories Submit Joint Letter Requesting $50 Million for the NACA Program for FY 2025

Today, the Native CDFI Network (NCN) and 68 Native CDFI and other partner organizations submitted a joint request letter to the U.S. Senate and House Appropriations Committees requesting a $50 million appropriation for the CDFI Fund’s Native American CDFI Assistance (NACA) Program for FY 2025.

Read MoreShare Your Input: How Does the Federal Funding Pause Impact Native CDFIs?

On January 27, 2025, the Office of Management and Budget (OMB) issued Memo M-25-13, temporarily pausing federal grant, loan, and financial assistance programs.

Read MoreNative CDFI Emergency Webinar: Temporary Pause on Federal Grant Activities

The purpose of this webinar is to ensure that Native CDFIs take a proactive role in shaping the narrative and representing the Native CDFI industry during this period of change.

Read MoreNCN Appoints Imogene Manuelito as CCIA Quality Assurance Manager

The Native CDFI Network is thrilled to welcome Imogene Manuelito (Navajo Nation) as our new CCIA Quality Assurance Manager (QAM)

Read MoreA Call to Action for Sustainable Energy Solutions in Indian Country

Pete Upton, CEO of the Native CDFI Network (NCN), and Luke Robinson, CCIA Regional Coordinator, participated in the Native American Development Corporation's (NADC) Tribal Energy Sovereignty & Green Energy Summit held from January 22-24, 2025, in Billings, Montana.

Read MoreNCN Invites Native CDFIs to Join Sign-on Letter Requesting $50 Million for the CDFI Fund’s Native American CDFI Assistance (NACA) Program for FY 2025

Advancing one of its top policy priorities for 2025, the Native CDFI Network invites all Native CDFIs as well as other key Indian Country stakeholder and partner organizations to join its sign-on letter to Congressional leadership requesting a $50 million appropriation for the CDFI Fund’s Native American CDFI Assistance (NACA)...

Read MoreNCN’s Policy & Advocacy in Action: Senator Lummis Uplifts Importance of Native CDFIs in HUD Secretary Confirmation Hearing

During last week’s Senate Banking Committee Hearing for Housing and Urban Development Secretary Nominee Scott Turner, Lummis uplifted the role of Native CDFIs in addressing Indian Country’s housing and homeownership crisis.

Read MoreJoin Us in Montana at the Tribal Energy Sovereignty & Green Energy Summit!

The Native CDFI Network has partnered with the Native American Development Corporation (NADC) to bring you the Tribal Energy Sovereignty & Green Energy Summit at the Double Tree By Hilton in Billings, MT January 22-24, 2025.

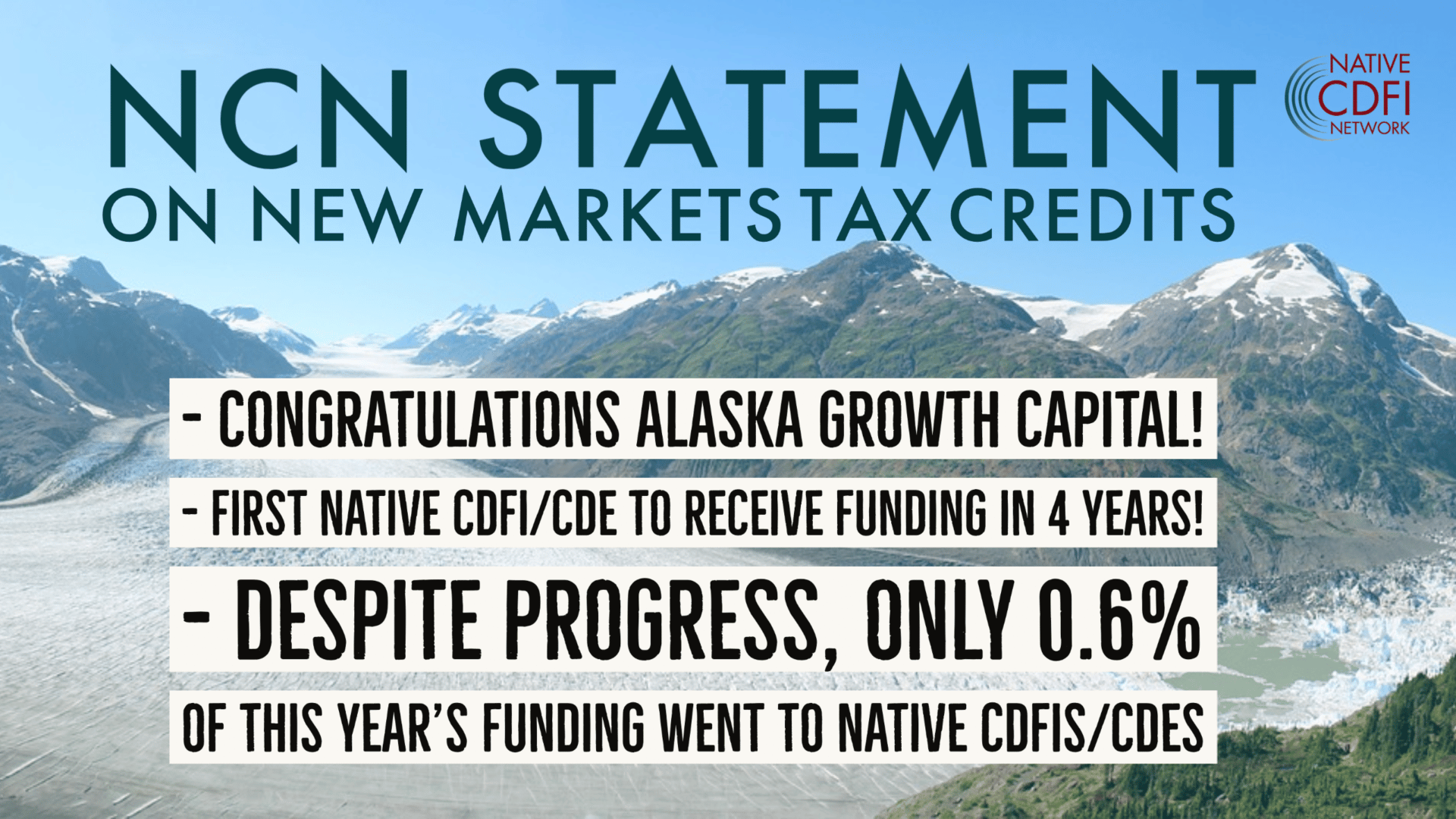

Read MoreDeadline to Apply for New Markets Tax Credit Allocations through the CDFI Fund is Fast Approaching

The Native CDFI Network (NCN) strongly encourages all Treasury-certified Native Community Development Entities (CDEs) to apply for the CDFI Fund’s Calendar Year (CY) 2024-2025 New Markets Tax Credit (NMTC) Allocation, which has an application deadline of Wednesday, January 29, 2025.

Read MoreUpcoming Workshop: Economic Systems as a Structural Driver of Population Health—Democracy and Governance

NCN CEO Pete Upton will be participating in a conversation on "Indigenous Examples of Governance, Democracy, and Economic Change" on February 3, 2025 at 1:00 p.m. PT.

Read MoreThank You for Joining NCN’s 5th Annual Policy & Advocacy Summit!

A message from NCN's CEO, Pete Upton, to those who attended the 2024 Annual Summit.

Read MoreLandmark Partnership Makes AI-Powered Funding Platform Free for a Decade to All 574 Tribal Nations

The U.S. Department of Interior’s Office of Strategic Partnerships (OSP), Native CDFI Network, and Syncurrent announced a historic, 10-year partnership to gift Syncurrent to all 574 Tribal Nations free of charge.

Read MoreNative CDFI Network Joins 14 Other Native Organizations on Economic Policy Brief for 119th Congress

Today, 15 prominent Native organizations – a group that includes the Native CDFI Network (NCN) – released a joint brief titled “Tribal Economic Development: Indian Country’s Policy Priorities for the 119th Congress” for incoming and returning members of Congress and their staff.

Read MoreNCN CEO Attends Treasury’s 30th Year Anniversary Celebration of the CDFI Fund

A message from NCN CEO Pete Upton after his attendance at the 30th Anniversary of the Community Development Financial Institutions (CDFI) Fund.

Read MoreCDFI Fund Announces $3.72M in NACA Technical Assistance Awards for FY 2024

The CDFI Fund awarded a total of $3.72 million in NACA TA funding to a total of 10 Native entities from among 15 such applicants, a group that included the Native CDFI Network (NCN).

Read MoreNative CDFI Network Joins 13 Other Native Organizations on Economic Policy Brief for Trump Administration Transition Team

Yesterday, 14 prominent Native organizations – a group that includes the Native CDFI Network (NCN) – shared a joint brief titled “Tribal Economic Development: Indian Country’s Policy Priorities for the Federal Government” with key members of the incoming Trump Administration’s transition team.

Read MoreBay Bank Drives Collaborative Opportunities for Native CDFIs

NCN CEO Pete Upton visited Green Bay, Wisconsin to meet with Jeff Bowman, President and CEO, and Nathan King, Vice President of Bay Bank, a tribally owned bank with the Oneida Indian Tribe of Wisconsin, where they discussed opportunities within the GGRF CCIA program, emphasizing the importance of collaboration among Native financial institutions to advance clean energy...

Read MoreDriving Change at Wisconsin Indigenous Housing & Economic Development Corporation’s 1st Annual Economic Development Conference

The 2024 Wisconsin Housing & Economic Development Conference (WIHEDC) that took place November 7-8 at North Star Mohican Casino Resort brought together Native Community Development Financial Institutions (CDFIs) to enhance economic development for Native American communities in Wisconsin.

Read MoreThe Native CDFI Network’s Commitment to the Future of Native Communities

NCN CEO provides a brief message about the CCIA program as it relates to NCN and the new administration.

Read MoreNative CDFI Network Announces New Team Members

We’re excited to welcome two exceptional professionals to the Native CDFI Network team: Alex Mendoza, CFO, and Stephanie Prater, Senior Financial Manager.

Read MoreNCN and 23 Co-Signatory Organizations Submit Comment Letter Addressing Transaction Level Report Changes to CDFI Equitable Recovery Program

Today, the Native CDFI Network (NCN) and 23 Native CDFI and other partner organizations submitted a comment letter responding to the CDFI Fund’s request for public comment regarding the Fund’s proposed changes to the annual Transaction Level Report (TLR) that entities participating in the CDFI Equitable Recovery Program (ERP) must...

Read MoreNative CDFI Network Launches $400M Clean Energy Initiative for Native Communities

The Native CDFI Network (NCN) hosted the inaugural rollout of the Clean Communities Investment Accelerator (CCIA) event in Omaha, Nebraska, on October 10-11, 2024.

Read MoreNCN Invites Native CDFIs, Partner Organizations to Join Comment Letter Addressing Transaction Level Report Changes to CDFI Equitable Recovery Program

The Native CDFI Network (NCN) invites Native CDFIs and partner organizations to sign on to its letter responding to the CDFI Fund’s request for public comment regarding the Fund’s proposed changes to the annual Transaction Level Report (TLR) that entities participating in the CDFI Equitable Recovery Program (ERP) must complete to maintain compliance.

Read MoreNCN Live: Formulating Native CDFIs’ Policy Priorities for 2025

The Native CDFI Network (NCN) invites all Native CDFI leaders and key decision-makers to join its webinar on Thursday, October 24, when we will be collectively formulating NCN’s consensus-based policy priorities for 2025.

Read MoreNCN Live: Funding for Mission Lenders through SBA’s Community Advantage Program

At the Native CDFI Network’s next NCN Live webinar, attendees will learn how Native CDFIs can access funding through the U.S. Small Business Administration (SBA) 7a Loan Program as Community Advantage Small Business Lending Companies (CA SBLCs).

Read MoreCDFIs and Greenhouse Gas Reduction Fund Take Center Stage at U.S. Treasury Panel Discussion

NCN CEO Pete Upton provides a comprehensive analysis of the opportunities and challenges CDFIs face in implementing climate-focused initiatives at the U.S. Treasury Advisory Board Meeting.

Read MoreGreat Lakes Tribal Economic Summit Highlights Clean Energy Finance and Native CDFIs’ Role in Indian Country

NCN CEO Pete Upton participates in a clean energy finance panel at the Great Lakes Tribal Economic Summit.

Read MoreThank you Guests and Supporters of NCN’s Eastern Regional Event!

The Native CDFI Network, in partnership with NeighborWorks America and Four Directions Development Corporation, hosted a three-day event titled “Building Sustainable Native Economies” in northern Maine from Sept. 9-11.

Read MoreNCN will join Clean Energy Panel at the CDFI Fund’s Public Advisory Board Meeting

NCN CEO Pete Upton will join the clean energy panel in Washington, D.C. at the CDFI Fund's Advisory Board meeting to discuss the U.S. Environmental Protection Agency’s (EPA) $27 Billion Greenhouse Gas Reduction Fund (GGRF).

Read MoreNCN Appoints Jodi Fischer as CCIA Regional Coordinator

Please join us in welcoming Jodi Fischer (Wyandotte Tribe of Oklahoma), who has recently joined the Native CDFI Network as our new Regional Coordinator for the Clean Communities Investment Accelerator (CCIA) program.

Read MoreNCN Live: Meet the New CDFI Fund Director and Discover Key Updates

Join us for an exciting and informative episode of NCN Live as we introduce the new Director of the CDFI Fund, Pravina Raghavan.

Read MoreNCN CEO Pete Upton Speaks on Native CDFI Network’s Role in Advancing Tribal Energy and Climate Initiatives

On August 21-23, 2024, Pete Upton, CEO of the Native CDFI Network (NCN), joined a distinguished panel at the Nation Building Conference in Lewiston, Idaho, focusing on Tribal Energy and Climate Initiatives.

Read MoreNCN Live: Understanding the CDFI Fund’s Proposed Changes to the Equitable Recovery Program (ERP) Transaction Level Reporting (TLR)

NCN invites you to attend a webinar on September 18 from 3:30 to 4:45 p.m. ET to learn about these proposed changes and their implications for Native CDFIs’ compliance with the CDFI ERP regulations.

Read MoreNCN Appoints Pamela Boivin as CCIA Program Manager

The Native CDFI Network (NCN) is thrilled to announce the newest addition to our team, Pamela Boivin (Menominee Indian Tribe of Wisconsin), who will be stepping into the role of CCIA Program Manager.

Read MoreStatement from NCN CEO Pete Upton: Action Needed to Preserve/Boost Funding Increase for NACA Program in FY 2025 Appropriations Bills

Thanks to the relentless advocacy of the Native CDFI Network and the Native CDFIs you lead, the current Congressional Appropriations bills for Fiscal Year (FY) 2025 feature a 25 percent increase in funding for the Native American CDFI Assistance (NACA) Program administered by the CDFI Fund.

Read MoreNCN Live: USDA Rural Energy for America Program

Join NCN Live and USDA officials on Wednesday, September 4 at 2:00 p.m. ET as we discuss the REAP program as it relates to Native CDFIs.

Read MoreNative CDFI Network Awarded Historic $400 Million Clean Communities Investment Accelerator Allocation

Today, August 16, on the second anniversary of the Inflation Reduction Act, the U.S. Environmental Protection Agency (EPA) announced the allocation of $27 billion in grants through three competitions as part of the Biden-Harris Administration's Investing in America agenda. EPA’s historic $27 billion Greenhouse Gas Reduction Fund has been made...

Read MoreNCN Releases 2024 Q2 Report

The Native CDFI Network officially released its 2024 Q2 Policy and Advocacy Report which outlines NCN’s major policy and advocacy achievements and advancements from the second quarter of 2024.

Read MoreCDFI Certification/Recertification TA Available for NCN Native CDFI Members

NCN is currently offering free technical assistance to support our Native CDFI members with certification/recertification.

Read MoreNative CDFI Network Awarded SBA PRIME Grant for 2024-2025

The Small Business Administration (SBA) has announced the awardees for the 2024 Program for Investment in Microentrepreneurs (PRIME). The Native CDFI Network (NCN) will receive $400,000 to enhance its efforts in supporting Native CDFIs.

Read MorePowering the Future: Transforming Clean Energy Finance in Indian Country

Tribal Business News spoke with five leaders who are set to play pivotal roles in transforming clean energy finance across Indian Country, including NCN CEO Pete Upton.

Read MoreNCN Live: Native Community Development Financial Relending Demonstration Program

The Native CDFI Relending Demonstration program is designed to improve homeownership opportunities for Native American Tribes, Alaska Native Communities, and Native Hawaiian Communities in rural areas.

Read MoreNCN Career Opportunity Available: CCIA Regional Coordinator

The Regional Coordinator for the Native CDFI Network Clean Communities Investment Accelerator program will play a critical role in driving the program's success by coordinating and supporting regional initiatives.

Read MoreNative CDFI Network and Wells Fargo Partner to Boost Economic Opportunities for Native Communities in California and Nevada

The Native CDFI Network (NCN), with support from Wells Fargo, is launching a year-long initiative to enhance economic opportunities and financial inclusivity for Native American communities in California and Nevada. This critical program aims to strengthen existing Native Community Development Financial Institutions (Native CDFIs) and foster the creation of new...

Read MoreNCN’s Recent Travel and Advocacy Efforts

Pete Upton, NCN CEO, and Kristen Wagner, NCN National Program Director, have been on the road sharing our story, gathering clean energy lending ideas and best practices from around the country, and developing partnerships to move the Clean Communities Investment Accelerator (CCIA) program forward.

Read MoreAlaska Native and Native Hawaiian Entities – Elective Pay Overview Webinars

Join the U.S. Department of the Treasury to discuss how Alaska Native Entities and Native Hawaiian Entities may benefit from new Inflation Reduction Act opportunities for access to clean energy credits through Elective Pay and Transferability.

Read MoreNCN Provides TA for Second Cohort – Initiate Prosperity

The Native CDFI Network is excited to offer our Native CDFI members a valuable online platform designed to enhance the success of your Native small business owners, which in turn, adds value to your investments in communities you serve.

Read MoreJoin our Team at the Native CDFI Network: Program Manager Opening

Join Our Team at the Native CDFI Network! Apply today for our Program Manager opening.

Read MoreNCN Releases 2024 Q1 Report

The Native CDFI Network (NCN) officially released its 2024 Q1 Policy and Advocacy Report for NCN members, supporters, partners, and other key stakeholders.

Read MoreNCN Invites Native CDFIs, Other Key Organizations to Sign on to Joint Letter Supporting Tribal Rural Housing Access Act

The Native CDFI Network (NCN) invites Native CDFIs and other key Native organizations to sign on to a joint letter to Congress expressing formal support for the Tribal Rural Housing Access Act (S. 3906) with certain proposed technical revisions that Senator Elizabeth Warren, the bill’s sponsor, plans to include in...

Read MoreNew NCN Member Opportunities

NCN is dedicated to its Native CDFI members and providing tools to support economic development and sustainability in Native communities. We are excited to offer two opportunities: 'Finding a Native CDFI' Map and a second onboarding process for Initiate Prosperity.

Read MoreNCN Difference Makers 2.0 Launching Soon!

NCN and Tribal Business News will shine a spotlight on the people accelerating change in Indian Country through this new podcast.

Read MoreNCN Team Joins GGRF Awardee Convening in Washington, D.C.

NCN’s CEO, Pete Upton, and National Program Director, Kristen Wagner participated in a convening at The National Press Club in Washington, D.C. hosted by the Center for Impact Finance at the University of New Hampshire's Carsey School of Public Policy.

Read MoreBiden-Harris Administration Announces $7 Billion Solar for All Grants

The Native CDFI Network extends sincere congratulations to all awardees of the Solar for All program!

Read MoreThe Native CDFI Network is Awarded $400 Million in a Historic Bid for Clean Energy

With profound gratitude, I am honored to announce that the Native CDFI Network has been selected to receive the historic Clean Communities Investment Accelerator (CCIA) award $400M, as part of the Greenhouse Gas Reduction Fund.

Read MoreNCN Invites Native CDFIs and Community Development Entities to Join Comment Letter on the New Markets Tax Credit Allocation Application

In response to a request for public comment from the CDFI Fund, NCN developed the comment letter, which features several consensus-based priorities to streamline and strengthen the NMTC Program Allocation Application process to ensure Indian Country’s equitable access to and usage of NMTC Program allocations.

Read MoreNCN Endorses Senator Warren’s New Bill Guaranteeing Housing Funds for Rural Tribal Communities

On March 12, 2024, United States Senator Elizabeth Warren (D-Mass.) announced new legislation to expand housing access for rural tribal communities: the Tribal Rural Housing Access Act. The legislation would direct the Department of Agriculture (USDA) to set aside 5% of certain Rural Housing Service (RHS) funds for Tribal Nations, tribally designated...

Read MoreNCN CEO Attends the 2024 National Interagency Community Reinvestment Conference

Last week, the Native CDFI Network (NCN) CEO Pete Upton participated in a discussion on opportunities for private lending and investment in Indian Country, during the National Interagency Community Reinvestment Conference (NICRC) in Portland, Oregon.

Read MoreUpdated Administration and Congress Multi-Partner Economic Policy Briefs

In the fall of 2023, the Native CDFI Network and 11 other Native organizations joined together to develop companion economic policy briefs focused on concrete steps Congress and the Biden Administration can take to boost tribal economies and Native-owned businesses.

Read MoreFree Native Solar Lending Training Kicks Off this Week!

The Native CDFI Network, University of New Hampshire, and Inclusiv are partnering to deliver a free solar lending training course designed for Native CDFIs.

Read MoreNCN Live: USDA Rural Development’s Rural Microentrepreneur Assistance Program

If you’re a Native CDFI or a Tribally focused lender looking to start (or grow your) lending to rural businesses in your community to create local jobs, or you provide loans, training and technical assistance specifically focused on rural microentrepreneurs, this webinar is for you.

Read More2024 NCN Institute Training Series Commences This Week

The NCN Institute Training Series is an interactive collection of workshops for Native CDFI leaders and team members who wish to sharpen their skills and strategies.

Read MoreNCN Hosting Two Conversations at RES 2024

As part of the National Center for American Indian Economic Development’s (NCAIED) 2024 Reservation Economic Summit (RES) in Las Vegas, NV, the Native CDFI Network (NCN) will host two sessions focused on clean energy finance.

Read MoreNCN Launches New Technical Assistance Benefit to Members – Initiate Prosperity!

The Native CDFI Network is excited to offer our Native CDFI members a valuable online platform designed to enhance the success of your Native small business owners, which in turn, adds value to your investments in communities you serve.

Read MoreA Message from NCN CEO Pete Upton in Response to New Federal Reserve Bank Report Detailing Banking Deserts’ Disproportionate Impact on Native Communities

The Federal Reserve Bank of Philadelphia released a comprehensive new report titled “U.S. Bank Branch Closures and Banking Deserts,” which finds that banking deserts – defined as neighborhoods with no bank branches nearby.

Read MoreNCN Signs on to Joint Letter Supporting the Native American Entrepreneurial Opportunity Act (S. 1156)

The Native CDFI Network and 17 other undersigned organizations write in strong support of the bipartisan Native American Entrepreneurial Opportunity Act (S. 1156) introduced by Senators John Hickenlooper (D-CO) and Cynthia Lummis (R-WY).

Read MoreNative CDFI Network Signs on to Joint Letter Protecting Greenhouse Gas Reduction Fund from Congressional Attack

Today, the Native CDFI Network (NCN) signed on to a joint letter along with several hundred other stakeholder organizations from across the lender community calling on Congress to protect the EPA Greenhouse Gas Reduction Fund (GGRF) from forthcoming legislation by House Republicans to gut the GGRF and divert its funding...

Read MoreNCN Signs on to Joint Letter Supporting SBA Office of Native American Affairs (H.R. 7102)

The Native CDFI Network (NCN) and 17 other co-signatory organizations submitted a letter to Congress supporting the bipartisan Native American Entrepreneurial Opportunity Act (H.R. 7102) introduced by Representatives Sharice Davids (D-KS) and Eli Crane (R-AZ) last week.

Read MoreNCN and Partners Send Letter of Support to Congress for Two Bills Benefiting Native CDFIs

The Native CDFI Network (NCN) and their 27 sign-on partners, sent a letter to Congressional leadership and the U.S. Senate Community Development Finance Caucus.

Read MoreNCN’s 2024 Policy Priorities are Now Available

The Native CDFI Network Policy Priorities for 2024 are now available.

Read MoreNCN Invites Native CDFIs and Partners to Sign on to Joint Letter Supporting the Scaling Community Lenders Act of 2023 and The Community Development Investment Tax Credit Act of 2023

The Native CDFI Network (NCN) invites your organization to join its letter to Congressional leadership and the U.S. Senate Community Development Finance Caucus. The intent of this letter to Congress is to show support for the Scaling Community Lenders Act of 2023 (S. 1442) and the Community Development Investment Tax Credit...

Read MoreNCN, Partner Organizations Release Economic Policy Priorities for Indian Country

Twelve leading Native organizations – including the Native CDFI Network – have joined together to develop companion economic policy briefs focused on concrete steps Congress and the Biden Administration can take to boost tribal economies and Native-owned businesses

Read MoreOutstanding Leadership and Organizational Excellence Recognized at Native CDFI Network’s Annual Summit

During its Annual Policy and Capacity-Building Summit last week, the Native CDFI Network (NCN) took a moment to bestow its Outstanding Leadership and organizational Excellence awards on two deserving recipients.

Read MoreNCN Releases 2023 Annual Report!

The Native CDFI Network (NCN) officially released its 2023 Policy and Advocacy Report for NCN members, supporters, partners, and other key stakeholders.

Read MoreBriefing on Native CDFIs Hosted by the U.S. Senate Committee Development Finance Caucus

NCN's CEO Pete Upton participated in a briefing hosted by the U.S. Senate Community Development Finance Caucus.

Read MoreNew Markets Tax Credit Native Initiative Webinar

In partnership with Big Water Consulting, we invite you to join us for an upcoming New Markets Tax Credit Native Initiative Webinar!

Read MoreModernized Community Reinvestment Act and Indian Country Recorded Webinar is Available

NCN and The Center for Indian Country Development co-hosted a webinar on the recent updates to the regulations implementing the Community Reinvestment Act (CRA) and how Indian Country could benefit

Read MoreTreasurer Chief Malerba Joined Native CDFI Network Policy and Capacity Building Summit to Discuss Expanding Economic Opportunity in Tribal Communities

U.S. Treasurer Chief Lynn Malerba delivered remarks and participated in a panel discussion at the 2023 Native CDFI Network Policy and Capacity Building Summit on expanding economic opportunity in Tribal communities.

Read MoreCongressional Appropriations Action Alert: NCN Calls on All Native CDFIs to Advocate This Week for Increases – Not Cuts! – to the CDFI Fund for FY 2024

The U.S. House of Representatives is slated to vote this week on its Financial Services and General Government spending bill for FY 2024, which contains steep cuts to several programs, including a $46 million decrease in funding for the CDFI Fund (a nearly 15% cut from its enacted FY 2023...

Read MoreNCN Provides Initial Analysis of New Final Rule Governing the Community Reinvestment Act

Based on the focus of NCN’s comments and the priorities the organization shared for how the CRA regulations should be strengthened to better serve Indian Country, the Final Rule overall represents a marked improvement over the current regulations, yet some priorities were not included in the new regulations.

Read MoreNCN Attends 2023 Freedman Bank Forum

NCN's CEO Pete Upton, participated in the 2023 Freedman's Bank Forum, hosted at the U.S. Department of the Treasury. The event underscored the urgency of addressing economic disparities and fostering inclusivity across the nation. The forum featured a dynamic array of sessions, comprising enlightening video messages and invigorating panel discussions.

Read MoreNCN Meets with SBA Administrator Guzman

NCN's CEO Pete Upton met with Administrator Isabel Guzman of the U.S. Small Business Administration (SBA) and Jackson Brossy, from the SBA Office of Native American Affairs, on October 25, 2023, in Washington, D.C.

Read MoreNative CDFIs Face Both Challenges and Opportunities in October

Native CDFIs face the pending release of potentially disastrous certification updates from the U.S. Treasury this month. At the same time, the Native CDFI Network is working on an application to tap into a $6 billion pot of money through an accelerator program under the Greenhouse Gas Reduction Fund.

Read MoreEmpowering Collaboration: Native CDFI Leaders Drive Change

Native Community Development Financial Institution (CDFI) leaders recently came together for a meeting with the Consumer Protection Finance Bureau (CFPB) Director Rohit Chopra and Chief Strategy Officer David Uejio.

Read MoreCreating Connections at OFN’s Annual Meeting

The NCN team participated in the 2023 Opportunity Finance Network (OFN) Conference in Washington, D.C. from October 15-18. NCN CEO, Pete Upton, addressed the Native convening session, providing an update on policy advocacy wins of 2023 to date, submission of the only exclusively Native-serving application to the EPA’s Clean Communities...

Read MoreNCN Awarded SBA PRIME Grant

NCN was recently awarded an SBA Program for Investment In Microentrepreneurs (PRIME) grant to build on the successful capacity-building programs and services to NCDFIs.

Read MoreNCN Expands Its Historic Indian Country Bid for Clean Energy – Partners with Climate United

NCN is supporting an application to the National Clean Investment Fund (NCIF) program with Climate United, a consortium comprised of Calvert Impact, Community Preservation Corporation, and Self-Help. NCN’s CEO, Pete Upton, will serve on Climate United’s Advisory Council.

Read MoreNative CDFI Network Submits Only Exclusively Native-Serving Application to EPA’s Clean Communities Investment Accelerator Award Program in Historic Indian Country Bid for Clean Energy

In a historic bid to catalyze clean energy infrastructure development in Native communities across the entire nation, today the Native CDFI Network (NCN) submitted a comprehensive Indian Country application to the Clean Communities Investment Accelerator (CCIA), one of three award programs under the U.S. Environmental Protection Agency (EPA) Greenhouse Gas...

Read MoreNCN CEO Pete Upton Champions Students Toward Environmental Studies

On October 6, 2023, CEO, Pete Upton participated as a speaker in the Johnson Scholarship Foundation's annual meeting held in Scottsdale, Arizona. The gathering brought together representatives from ten schools that actively participate in the foundation's business scholarship programs.

Read MoreNCN CEO Pete Upton Remarks on Native “Woven Economies”

On October 3-4, 2023, Pete Upton, the CEO and Chairman of the Native CDFI Network, made a keynote speech at the 2023 Northwest Native Economic Summit.

Read MoreNCN CEO Pete Upton Speaks at the 2023 Clinton Global Initiative

Upton's participation in the panel discussion titled "Financing the Underfinanced: Lessons Learned Across Geographies" was a testament to the Native CDFI Network’s dedication to advancing financial inclusion for indigenous populations.

Read MoreNCNs CEO Pete Upton Presents at the Tribal Business News Great Lakes Tribal Summit

Under the theme "Native CDFIs | Funding Native Housing, Tribal Economies," Upton passionately conveyed the pivotal role that Native Community Development Financial Institutions (CDFIs) are playing in supporting Native homeownership, empowering Indigenous small businesses, and fueling community development initiatives within Indian Country.

Read MoreNCN’s CEO Pete Upton to Speak at the Clinton Global Initiative

Upton was asked to participate at the Clinton Global Initiative to share the work Native CDFIs are doing to grow thriving economies across Indian Country.

Read MoreNCN Hosts Strategy Session with USDA Rural Development

As part of a two-year cooperative agreement with the United States Department of Agriculture – Rural Development (USDA RD) Office of Tribal Relations (OTR), the Native CDFI Network (NCN) will be producing an electronic resource toolkit (NCN e-toolkit) to promote awareness of and increase access to Rural Development programs that...

Read MoreNative CDFI Leaders Share Key Priorities and Concerns with Treasury and the CDFI Fund in Listening Session

Native CDFI leaders from across the country shared their priorities and concerns regarding a number of critical issues with U.S. Department of the Treasury and CDFI Fund officials, a group that included Chief Lynn Malerba, Treasurer of the United States, and Noel Andrés Poyo, Treasury’s Deputy Assistant Secretary for Community...

Read MoreJoin NCN to Apply for Funding Through the Greenhouse Gas Reduction Fund

NCN is seeking Native CDFI partners to pursue Greenhouse Gas Reduction Fund opportunities.

Read MoreNCN CEO Pete Upton Appointed to Justice Climate Fund Board

NCN CEO Pete Upton has been appointed to the Justice Climate Fund Board, led by the Community Builders of Color Coalition.

Read MoreNative CDFI Network / Native Partnership for Housing Southwest Regional Event Recap

The Native CDFI Network, in collaboration with the Native Partnership for Housing and NeighborWorks America, recently hosted a transformative three-day event in Gallup, New Mexico, on August 9 - 11, 2023.

Read MoreNCN Submits Joint Sign-On Letter to Congress Requesting Increased Funding for the CDFI Fund and NACA Program for FY 2024

The Native CDFI Network (NCN) submitted to Congress a formal request letter signed by 38 Native CDFIs and other key stakeholder organizations requesting an increased FY 2024 appropriation for overall funding for the CDFI Fund and the Native American CDFI Assistance (NACA) Program specifically.

Read MoreNCN Wins Energizing Rural Communities Prize

The Native CDFI Network recently won an Energizing Rural Communities Prize!

Read MoreNCN Requests Native CDFI Input on the “State of Native American Housing”

Native CDFI responses are due Wednesday, August 4, by 5:00 p.m. Eastern time so that NCN can submit an official response to the Senate Subcommittee by the requested deadline of August 7, 2023.

Read MoreNative CDFI Network Releases White Paper Outlining EPA Greenhouse Gas Reduction Fund Opportunities for Native CDFIs

The Native CDFI Network (NCN) released its white paper providing a comprehensive overview of the funding opportunities available to Native CDFIs through the Greenhouse Gas Reduction Fund (GGRF), which is being administered by the U.S. Environmental Protection Agency (EPA).

Read MoreNCN Releases Quarterly Report Sharing Achievements on Behalf of Native CDFIs

The Native CDFI Network (NCN) today officially released its Q2 2023 policy and advocacy report for NCN members, supporters, partners, and other key stakeholders.

Read MoreNCN’s CEO, Pete Upton, Shares Knowledge with the Federal Reserve Bank of Kansas City

Tightening credit and rising costs pose challenges for low- and moderate-income (LMI) residents of the Federal Reserve Bank of Kansas City’s region. Community Development Advisory Council (CDAC) members shared their perceptions of trends related to banking volatility.

Read MoreTreasury Department Announces Formal Listening Session with Native CDFIs

Today, the U.S. Department of the Treasury announced it will host a Listening Session for Native Community Development Financial Institutions (CDFIs) on Friday, August 18, 2023 from 1:00 to 4:00 p.m. Eastern time.

Read MoreNCN Informational Webinar and Interested Partners Meeting on EPA Greenhouse Gas Reduction Fund Opportunities for Native CDFIs

To educate its members, partners, and other key Indian Country stakeholders, the Native CDFI Network (NCN) will be holding an informational webinar providing details on the GGRF next Thursday, July 27 from 2:00 to 3:00 p.m. Eastern time, during which it will release a white paper providing a comprehensive overview...

Read MoreNCN’s CEO Pete Upton Emphasizes the Value of Relationship in Lending

On July 11, 2023, the Opportunity Finance Network (OFN) and the Native CDFI Network (NCN) co-hosted a regional meeting of CDFI Executives that took place at the Federal Reserve Bank of Minneapolis.

Read MoreNCN Calls on Native CDFIs and Other Key Organizations to Join Sign-On Letter Requesting Increased Funding for the CDFI Fund and NACA Program for FY 2024

The Native CDFI Network (NCN) invites all Native CDFIs and other key Indian Country stakeholder organizations to sign on to a joint letter to Congress requesting an increased FY 2024 appropriation for overall funding for the CDFI Fund and the Native American CDFI Assistance (NACA) Program specifically.

Read MoreNCN’s CEO Pete Upton was a Featured Speaker at OWEESTA’s Capital Access Convening

Native CDFI Network’s (NCN) CEO, Pete Upton, was the featured speaker during a policy advocacy discussion at the OWEESTA Capital Access Convening.

Read More2023 NCN Institute Training Continues

The 2023 NCN Institute series continues! On June 21, one of our most popular trainers, Jack Northrup of New England Market Research, shared his expertise on Priming the Loan Pipeline.

Read MoreNCN Live Recap: Mel Willie with NeighborWorks America

Mel Willie, Director of Native Partnerships and Strategy, with NeighborWorks America joined "NCN Live" on June 22 for a conversation sharing an overview of NeighborWorks America and the spectrum of services and supports they provide to expand the development of Native housing and homeownership across the country.

Read MoreCongratulations to NCN Members who are SSBCI Award Recipients

The Biden-Harris Administration is announcing approval of the first 15 Tribal State Small Business Credit Initiative (SSBCI) awards for tribal governments funded by the American Rescue Plan, providing $73 million to 39 Tribal Governments to support Tribal enterprises and small business owners, as part of President Biden’s Investing in America...

Read MoreNCN CEO Pete Upton Testifies at Senate Subcommittee Meeting on the ‘State of Native American Housing’

On Tuesday, June 13, Native CDFI Network's CEO Pete Upton attended a Senate subcommittee meeting on the ‘State of Native American Housing’.

Read MoreNCN’s CEO Pete Upton Amplifies Native Voices in Climate Justice Conversations and Financial Innovation Roundtable

From June 15-16, 2023 NCN's Pete Upton participated on panels at the Financial Innovation Roundtable and the African American Alliance of CDFI CEOs - Unapologetically Building Black Equity Conference.

Read MoreNCN’s CEO, Pete Upton, Attends South Dakota Native Homeownership Coalition’s 10th Annual Convening

From June 6 to 8, 2023, Native CDFI Network's CEO, Pete Upton, attended South Dakota Native Homeownership Coalition's 10th Annual Convening, site visit, and Lender Symposium in Fort Thompson, South Dakota.

Read MoreJoin us for the OFN and NCN Joint Midwest Regional Meeting

Join NCN on July 11, 2023, for the OFN & NCN Joint Midwest Regional Meeting in Minneapolis, MN.

Read MoreIn Case You Missed It: NCN Leadership Institute Training Series Highlights

The 2023 NCN Institute kicked off in May with a sold-out crowd! The virtual training series began with a two-part workshop held on May 3 and 17 focused on Capitalization Planning. This popular workshop was facilitated by Caleb Selby, of Selby Consulting, who has provided a variety of consultative services...

Read MoreNCN’s CEO Pete Upton Attended the U.S. Treasury Convening on Climate-Focused Community Finance

On May 10, 2023, a meeting was held by the U.S. Treasury on climate-focused community finance. Pete Upton, the CEO of the Native CDFI Network, attended the meeting along with various government officials and experts in the field.

Read MoreNCN Submits Two Comment Letters in Support of Native CDFIs that Feature Strong National Support from Key Partners

On Friday, May 12, the Native CDFI Network (NCN) submitted formal comment letters to federal agencies sharing and advancing the consensus priorities of Native CDFIs and key national partners on two key policy and funding issues: (1) the Native American CDFI Assistance Program (NACA Program) Financial Assistance (FA) and Technical...

Read MoreNCN Live: Input Needed on CDFI/NACA FY 2023-2025 Financial Assistance and Technical Assistance Applications

On May 2nd at 2 p.m. ET, NCN hosts Treasury’s Deputy Assistant Secretary for Community Economic Development (OCED) Noel Andrés Poyo and Lisa Wagner of Bluestem Consulting. Part I: Noel Poyo will share information about Treasury’s work related to Native CDFIs and Native communities. He will then remain on the...

Read MoreMore Than 60 Native CDFIs, Prominent National Organizations Sign on to NCN Letter Requesting $50 Million for NACA Program

The Native CDFI Network (NCN) sent a letter to Congressional leadership requesting a $50 million appropriation for the CDFI Fund’s Native American CDFI Assistance (NACA) Program for FY 2024. Featuring a total of 65 organizational co-signatories, the letter requests this increased funding amount for FY 2024 based on the considerable...

Read MoreTribes Playing Key Role in Global Solar Buildout, Experts Tell Native CDFIs

Native people already are playing key roles in helping to reduce carbon emissions while building their own energy sovereignty, but there is more work to be done, solar experts told Native CDFI leaders during an April 18 solar energy webinar. “We all know the needs are immense,” said Christian Weaver,...

Read MoreNCN Invites Native CDFIs and Other Key Stakeholder Organizations to Join Letter Requesting $50 Million from Congress for NACA Program for FY 2024

The Native CDFI Network (NCN) invites all Native CDFIs and other key Indian Country stakeholder organizations to join its letter formally requesting that Congress appropriate $50 million for the Native American CDFI Assistance Program for Fiscal Year 2024. NCN is requested this increased funding amount for FY 2024 based on the...

Read MoreNCN News for April 17, 2023

Native CDFIs Receive $47.5 Million Capital Infusion Through CDFI Fund’s Equitable Recovery Program Last week, the Department of the Treasury’s CDFI Fund announced awards totaling $1.7 billion to more than 600 Treasury-certified CDFIs through its Equitable Recovery Program (ERP), the largest grant program in the agency’s history. The long-awaited announcement...

Read MoreNCN News for April 3

NCN’s CEO Attends NCRC Just Economy Conference Native CDFI Network’s CEO Pete Upton attended National Community Reinvestment Coalition’s 2023 Just Economy Conference. Upton participated in a panel that explored a variety of investment and grant opportunities and highlighted efforts to build wealth in Indian Country. With banks initiating investments in Indian Country, Native...

Read MoreNCN’s CEO Attends Greenhouse Gas Reduction Fund Convening

Native CDFI Network's CEO Pete Upton participated in a roundtable meeting on March 21, 2023 hosted by JP Morgan Chase & Co. in Washington, D.C.

Read MoreCalling All Native CDFIs: Please Complete Two Short Surveys Sharing Your Greenhouse Gas Reduction Fund Needs!

As the largest national network of Native CDFIs, the Native CDFI Network is doing its part to ensure that Indian Country and specifically Native CDFIs receive their fair share of the significant funding available through the Inflation Reduction Act and its Greenhouse Gas Reduction Fund (GGRF), which provides Native CDFIs...

Read MoreNCN Calls on Congress to Increase Funding for HUD Section 4 Program and Establish Set-aside for Native Communities

In a letter to Congress, the Native CDFI Network, National American Indian Housing Council, and Sovereign Council of Hawaiian Homestead Associations is calling on legislators to strengthen the HUD Section 4 Capacity Building for Community Development and Affordable Housing (Section 4) Program for Indian Country in two critical ways.

Read MoreRegistrations are now open for the 2023 NCN Institute Training Series!

The NCN Institute Training Series is an interactive collection of workshops for Native CDFI leaders and team members who wish to sharpen their skills and strategies.

Read MoreNCN’s CEO/Chairman Provides a Recap of the CDFI Fund NMTC Program Native Initiative Training Technical Workshop

NCN CEO and Chairman Pete Upton travelled to Phoenix, AZ to attend a workshop on the CDFI Fund NMTC Program Native Initiative. This workshop was hosted by Big Water Consulting.

Read MoreNCN Live Recap: Building Sustainable Native Communities – Native CDFI & Tribal Collaboration

Leaders of two key Native American financial organizations met to discuss collaboration and shared goals in pursuit of economic development across Indian Country during the Feb. 23 episode of “NCN Live."

Read MoreNCN Live: The Native CDFI Network welcomes you to join a new series of conversations!

"NCN Live" is a new series of conversations with industry experts and policymakers designed to expand the power of Native CDFIs to grow economic opportunity for Native peoples.

Read MoreNCN Releases Comprehensive Survey Results Documenting Likely Impacts of Proposed CDFI Certification Changes

The Native CDFI Network (NCN) released the results of its comprehensive survey documenting the likely impacts the CDFI Fund’s proposed changes to the CDFI Certification Application and related regulations will have on Native CDFIs. More than 50 Native CDFI chief executives responded to the survey.

Read MoreCooperative Agreement between NCN and USDA, Office of Tribal Relations will Empower Native CDFIs to Access Rural Development Programs

In September 2022, USDA’s Office of Tribal Relations and USDA Rural Development entered into a 2-year cooperative agreement with the Native CDFI Network to build an electronic resource toolkit (NCN e-toolkit) to promote awareness of and increase access to Rural Development programs that support economic development in Indian Country.

Read MoreNCN Calls on All Native CDFIs to Submit Comments on the Proposed CDFI Certification Changes to the ACR and CTLR

The Native CDFI Network (NCN) strongly encourages all Native CDFIs and other key Indian Country stakeholder organizations to submit comments on the CDFI Fund’s proposed Annual Certification and Data Collection Report Form and the abbreviated Transaction Level Report (ACR/CTLR) as part of its proposed CDFI Certification overhaul.

Read MoreNCN’s CEO, Pete Upton, Reports on Access to Capital in Indian Country: How much? What kind? What impact?

No one doubts the need for more affordable capital to deploy in Indian Country. Unfortunately, there is little data to answer the main questions — how much, what kind and what for — that go along with that need.

Read MoreNative CDFIs: Please Complete 10-Minute Comprehensive Survey on Impacts of Proposed Changes to CDFI Certification

The Native CDFI Network (NCN) needs to hear more from you about how the CDFI Fund's proposed changes to CDFI Certification will impact your Native CDFI.

Read MoreNCN’s 3rd Annual Policy & Capacity-Building Summit Summary

Tribal Business News summarizes Native CDFI Network's three day annual summit that took place in early December, 2022.

Read MoreSenator Elizabeth Warren Unveils Sweeping Plan To Address ‘Broken Promises’ To Tribes

On December 5, 2022, U.S. Senator Elizabeth Warren (D-Mass.) and Congressman Derek Kilmer (D-Wash.) unveiled the Honoring Promises to Native Nations Act, historic legislation to address chronic underfunding and barriers to sovereignty faced by Indian Country as a result of the federal government’s failures to meet its trust and treaty responsibilities.

Read MoreNative CDFI Network uses Federal Reserve data to highlight the impact of investing in Indian Country

For years the Federal Reserve System has partnered with NCN to drive policy change by gathering reliable data to support the benefits of investing into Native CDFIs.

Read MoreNCN Calls on Native CDFIs and Other Key Organizations to Submit Comments on the CDFI Certification Target Market Assessment Methodologies by December 19th Deadline

The Native CDFI Network (NCN) strongly encourages all Native CDFIs and other key Indian Country stakeholder organizations to submit comments on the CDFI Fund’s proposed pre-approved list of Target Market assessment methodologies (TMAMs) (which are a key feature of the Fund's proposed new CDFI Certification regulations) by the comment deadline...

Read MoreNCN is Among 29 Nonprofits Awarded by Northwest Area Foundation

Northwest Area Foundation grantmaking supports organizations within the region of eight states and 76 Native nations that are advancing long-overdue change in deep connection with the land they inhabit and communities they serve—Native Americans, communities of color, immigrants, refugees, and people in rural areas. They’re on a journey to build...

Read MoreInterior Department Announces New Partnerships and Offices to Leverage New Resources for Indian Country – New Partners Include Native CDFI Network & Oweesta Corporation

In opening remarks at the 2022 White House Tribal Nations Summit, Secretary of the Interior Deb Haaland announced a series of actions to support Tribally led conservation, education and economic development through a new Office of Strategic Partnerships. The Department also announced a new joint project between the Bureau of...

Read MoreImportant: Location Changed for Annual Policy and Capacity Building Summit on Dec. 6-8

Due to the overwhelming response and expected attendance, the sold out Annual Policy and Capacity Building Summit has been moved to the Hyatt Regency Washington on Capitol Hill, Regency B – Ballroom Level 400 New Jersey Avenue NW, Washington, D.C., 20001. This will provide a much more comfortable and accommodating...

Read MoreNCN Webinar – FTC Resources on Consumer Protection Topics

On Thursday November 10th, 2022, NCN hosted a webinar with the FTC covering various consumer protection topics. You can watch the session in its entirety below:

Read MoreOpportunity to Comment on the New CDFI Certification Application

In October, the Community Development Financial Institutions Fund (CDFI Fund) provided a preview of the revisions to the new CDFI Certification Application. The CDFI Fund published the preview in advance of the Office of Management and Budget (OMB) releasing the updated application for a final round of public comment.

Read MoreNCN Needs Your Help to Get the Native American Rural Homeownership Improvement Act Passed by Congress!

The Native CDFI Network (NCN) encourages all Native CDFI and tribal leaders to contact their U.S. Congressional representatives to gain their support as co-sponsors of the Native American Rural Homeownership Improvement Act of 2021 (S. 2092/H.R. 6331). This critical legislation is gaining momentum in both the House and Senate, and...

Read MoreNCN Partners with BMO Harris to Launch U.S. Native-owned Business Program

NCN has partnered with BMO Harris Bank to launch BMO for Native-owned Businesses as part of its five-year, $5 billion BMO EMpower initiative aimed at supporting an inclusive economic recovery for minority businesses, communities and families through lending, investing, giving and engagement in local communities.

Read MoreEconomic Equity for Native Communities Begins with a Seat at the Table

On October 3-4, 2022, Native communities and Native CDFIs were represented at two high-profile federal events in Washington, D.C.: a Working Session of the Biden Administration’s Economic Opportunity Coalition and the U.S. Department of Treasury’s annual Freedman’s Bank Forum.

Read MoreNCN Hosts a Webinar with the Federal Trade Commission

Federal Trade Commission (“FTC”) attorneys Joannie Wei and Matt Schiltz will present on trending issues related to scams and other common consumer protection topics.

Read MoreNCN Interim CEO/Chairman and National Policy Chair Attend the Clinton Global Initiative

On September 19-20, 2022, NCN Interim CEO and Board Chair Pete Upton and National Policy Chair Robin Danner joined other global and emerging leaders in New York City to take action and address the world's most pressing challenges.

Read MoreCalendar Reminder: NCN Annual Policy and Capacity Building Summit – December 6-8, 2022

Native CDFI leaders, staff, and other interested stakeholders are encouraged to save December 6-8, 2022 on their calendars to attend the Native CDFI Network’s 2022 Annual Policy and Capacity Building Summit in Washington, D.C. The Summit will be held at the National Indian Gaming Association (NIGA) Conference Center near Capitol Hill —...

Read MoreNCN Interim CEO Pete Upton to be Featured on “The State of Native Housing” Webinar

Join the National Housing Conference for a webinar on The State of Native Housing: Programs, Policy, and Practices on Tribal Lands on Thursday, September 29, 2022 from 1:30 to 3:00 P.M. ET. NCN's Interim CEO, Pete Upton, will be a panel speaker during the webinar!

Read MoreNCN “Difference Makers” Interview Series: Jeff Tickle and Mary Miner

Last week, the Native CDFI Network released its latest edition of “Native CDFIs: Difference Makers for Indian Country,” an interview with Jeff Tickle, who serves as General Manager of Cook Inlet Lending Center, Inc. (CILC) in Anchorage, Alaska. Formerly known as NaQenq’a, CILC is a federally certified Native CDFI that was created in 2001 as...

Read MoreWebinar: CDFI Fund Issues Supplemental FAQs that Amend Equitable Recovery Program Guidelines

The Community Development Financial Institutions Fund (CDFI Fund) at the Department of Treasury issued a Supplemental FAQs that amends the geographic eligibility guidelines for the FY 2022 Equitable Recovery Program (ERP) to include federally designated tribal service counties and service areas as “eligible Native areas” for the purposes of ERP (for the full...

Read MoreNCN News for the Week of August 15

TACTIX: Free Online Training Program for Native Entrepreneurs! Apply Today! Register by Wednesday, August 17 for the Next TACTIX Training Cohort The Sequoyah Fund is proud to announce that their fifth TACTIX cohort will begin in September. TACTIX is a virtual course which provides Native entrepreneurs with tools to enhance their digital...

Read MoreNCN News for the Week of August 8

In early May, the three agencies tasked with regulating banking institutions' compliance with the Community Reinvestment Act (CRA) jointly released their much-anticipated Interagency CRA Notice of Proposed Rulemaking (NPR) designed to strengthen and modernized the regulations governing the Act.

Read MoreBreaking News: Your input needed on the CDFI Equitable Recovery Program (ERP) eligibility requirements.

On June 23, 2022, the Community Development Financial Institutions Fund (CDFI Fund) announced the opening of the FY 2022 CDFI Equitable Recovery Program (ERP) round with the public release of a Notice of Funds Availability (NOFA). The NOFA set forth the deadline for submitting the FY 2022 CDFI ERP Application...

Read MoreNCN News for the Week of August 1

U.S. Senate Announces Creation of Community Development Finance Caucus Today, U.S. Senators Mark R. Warner (D-VA) and Mike Crapo (R-ID) announced the creation of the Senate Community Development Finance Caucus (CDFC), a bipartisan caucus dedicated to supporting the missions of Community Development Financial Institutions (CDFIs) and Minority Depository Institutions (MDIs) to...

Read MoreBreaking News: Save the Date (August 10) for Conference Call for CDFIs in an ACR-Related Cure Period

The Community Development Financial Institutions Fund (CDFI Fund) is holding an informational conference call for those Community Development Financial Institutions (CDFIs) that are currently in a Certification cure period related to the submission of a 2021 or 2022 Annual Certification and Data Collection Report (ACR). The CDFI Fund recently announced that on...

Read MoreNCN News for the Week of July 25

Native CDFI Leaders’ Discussion: The Community Reinvestment Act NPR TODAY, July 25, 2:00 to 3:00 p.m. EDT Today, the Native CDFI Network (NCN) will convene Native CDFI leaders from across the country to discuss the Interagency CRA Notice of Proposed Rulemaking (NPR) for the Community Reinvestment Act. This important...

Read MoreNCN Hosts Webinar Showcasing the Success of the Section 502 Home Loan Demonstration Project

On Thursday, July 21, 2022, NCN hosted U.S. Representative Sharice Davids and USDA-Rural Development Under Secretary Xochitl Torres Small, along with Native CDFI leaders from the South Dakota Native Homeownership Coalition that included Tawney Brunsch, Joanna Donohoe, Stephanie Provost, and Lakota Vogel, in a conversation about Section 502 and the home loan demonstration project. Roundtable guests shared...

Read MoreNCN News for the Week of July 18

NCN Webinar: Growing the Success of the Section 502 Home Loan Demonstration Project Thursday, July 21, 1:00 to 2:30 p.m. EDT In this Thursday’s NCN webinar, U.S. Representative Sharice Davids and USDA-Rural Development Under Secretary Xochitl Torres Small will share with attendees about the highly successful demonstration project for the USDA Section 502 Home Loan Program,...

Read MoreNCN Hosts Webinar Highlighting Details of the CDFI Equitable Recovery Program (ERP)

On Thursday, July 14, 2022, NCN hosted CDFI Fund Senior Advisor Daniel Aiello who provided an overview of the CDFI Equitable Recovery Program (CDFI ERP). The FY 2022 funding round recently opened for this program, which will provide approximately $1.73 billion in awards to Treasury-certified CDFIs to (1) expand lending, grant making and investment activities...

Read MoreNCN Hosts Webinar on the SBA Community Advantage Program

NCN hosted an information session on Monday, June 27th for Native CDFIs to help answer any questions about the U.S. Small Business Administration’s (SBA) updated Community Advantage program, Jackson Brossy, SBA Assistant Administrator for Native American Affairs, and Veronica Pugin, SBA Senior Advisor Office of Capital Access shared information about the...

Read MoreNational Coalition of Native Organizations to Host Sessions on Community Reinvestment Act

Throughout the month of July, a national coalition of Native organizations including Native CDFI Network) in conjunction with the Center for Indian Country Development (CICD), will host a series of virtual sessions on how the Community Reinvestment Act (CRA) Notice of Proposed Rulemaking (NPR) could more effectively address the investment...

Read MoreNCN Hosts Webinar on the Native American Rural Homeownership Improvement Act of 2021 (S. 2092)

On Thursday, June 23, 2022, NCN hosted an action-focused webinar regarding the Native American Rural Homeownership Improvement Act of 2021 (S. 2092) with examples of how it could strengthen the USDA Section 502 Home Loan Program. Panelists included Lakota Vogel, ED of Four Bands Community Fund in South Dakota who...

Read MoreNative CDFI Network Congratulates Chief Lynn Malerba for Her Historic Appointment as Treasurer of the United States

The Native CDFI Network (NCN) applauds this week’s historic appointment of Chief Lynn Malerba of the Mohegan Tribe by President Biden as Treasurer of the United States. Malerba is the first Native person to be selected for this top federal post. Among her many important functions, Treasurer Malerba will oversee the newly...

Read MoreNCN News for the Week of June 23

Thursday, June 23 NCN Webinar: The Native American Rural Homeownership Improvement Act: Enhancing the USDA Section 502 Home Loan Program Native CDFI leaders, staff, and key stakeholders are invited to participate in this important webinar this Thursday, June 23 at 2:00 p.m. EDT to learn more about the Native American Rural Homeownership...

Read MoreNCN News for the Week of June 13

NCN WEBINAR with Federal Agencies This Thursday, June 16: “Modernizing the Community Reinvestment Act: The NPR’s Implications for Indian Country and Native CDFIs” This Thursday, June 16 at 2:00 p.m. EDT, NCN will host a special two-hour webinar featuring representatives from the federal agencies tasked with regulating lending institutions’ compliance with the Community...

Read MoreNCN News for the Week of June 6

Register for the June 16 NCN Webinar … “Modernizing the Community Reinvestment Act: The NPR’s Implications for Indian Country and Native CDFIs” On Thursday, June 16 at 2:00 p.m. EDT, NCN will host a special two-hour webinar featuring representatives from the federal agencies tasked with regulating lending institutions’ compliance with...

Read MoreNCN Hosts Webinar Featuring Initiate: A Blended Learning Approach to Small Business Technical Assistance by Northern Initiatives

On Thursday, May 19, 2022, NCN hosted Chris Wendel, Program Manager of Initiate, Northern Initiatives’ online portal of small business resources, and Jessa Armstrong, Customer Success Manager of Northern Initiatives. Initiate is an online collection of best practice business resources. With its vetted videos, resources, tools, and templates, Initiate helps...

Read MoreBreaking News: CDFI Fund Opens Application Period for Small Dollar Loan Program Funding

CDFI Fund Opens Application Period for Small Dollar Loan Program Funding – Native CDFIs Encouraged to Apply! Up to $11.1 Million Available for Loan Loss Reserves and Technical Assistance WASHINGTON – Today, the U.S. Department of the Treasury’s Community Development Financial Institutions Fund (CDFI Fund) opened the fiscal year (FY)...

Read MoreNCN This Week: May 16, 2022

On Wednesday, May 11, U.S. Secretary of the Interior Deb Haaland and Assistant Secretary for Indian Affairs Bryan Newland released Volume 1 of the investigative report called for as part of the Federal Indian Boarding School Initiative, a comprehensive effort to address the troubled legacy of

Read MoreNCN Hosts Webinar to Discuss CDFI Fund’s Small Dollar Loan Program

On Friday, May 13, 2022, NCN hosted Small Dollar Loan (SDL) Program Manager, Tanya McInnis, and SDL Senior Manager and Program Analyst, Julie Sandler, along with Sequoyah Fund Executive Director Russ Seagle (SDL Program participant). The Program, which provides grants for Loan Loss Reserves and Technical Assistance to enable Certified CDFIs to...

Read MoreNCN This Week: May 9, 2022

Join SDL Program Manager Tanya McInnis and Sequoyah Fund Executive Director Russ Seagle as they share about the SDL Program. The Program, which was created to encourage federally certified CDFIs to establish and maintain small-dollar loan programs and provide alternatives to

Read MoreNCN Hosts Webinar featuring Russ Seagle

On Friday, April 29, 2022, NCN hosted Russ Seagle, Executive Director of The Sequoyah Fund, Inc., located in Cherokee, NC. Seagle shared information about Tactix, a new mobile app and online learning community that offers a space for small business owners to access real-world business education and expand their network...

Read MoreNCN to Host Webinar Featuring Russ Seagle

Russ Seagle is the Executive Director of The Sequoyah Fund, Inc., located in Cherokee, NC. The Sequoyah Fund offers commercial loans, training, consulting, and coaching to small businesses located on the Qualla Boundary and the seven westernmost counties of North Carolina.

Read MoreU.S. Treasury Department Extends SSBCI Application Deadlines

WASHINGTON – The U.S. Department of the Treasury is extending the deadline for Tribal governments to initiate and submit their complete SSBCI Capital Program application to September 1, 2022, at 11:59 p.m. Eastern Time (ET) and the deadline to submit an application for the SSBCI Technical Assistance (TA) Grant Program to...

Read MoreNCN Hosts Webinar to Discuss SSBCI Programs

On Wednesday April 13, 2022, Native CDFI Network (NCN) hosted Pilar Thomas, Jeff Bowman, and Sanford Livingston to discuss the State Small Business Credit Initiative (SSBCI). The webinar was co-sponsored by Oweesta, the Sovereign Council of Hawaiian Homestead Associations and Clearinghouse CDFI. Jeff Bowman, President and CEO of Bay Bank...

Read MoreNCN Hosts Webinar featuring the U.S. Department of the Treasury

On Friday, April 8, 2022, NCN hosted James Colombe, Policy Advisor for the U.S. Department of the Treasury. Colombe discussed the implementation of the State Small Business Credit Initiative program in Indian Country. He shared updates about the program and fielded questions from attendees regarding its implementation and impact on...

Read MoreNCN This Week: April 5, 2022

In Case You Missed It: NCN’s 2022 Policy Priorities The Native CDFI Network recently released its Policy Priorities for 2022. The NCN Board of Directors and Policy Committee developed this comprehensive set of priorities at NCN’s Mid-Winter Policy Round Table event in Washington, D.C. in February. Designed to strengthen the policies and expand the resources supporting Native CDFIs across the country, these priorities include calling on...

Read MoreNCN Hosts Webinar featuring Indian Affairs, U.S. Department of the Interior

On Friday, April 1, 2022, NCN hosted Kathryn Isom-Clause, Deputy Assistant Secretary for Indian Affairs at the U.S. Department of the Interior. Isom-Clause discussed Indian Affairs’ overarching priorities to support tribal economy building and provided updates on key DOI/BIA programmatic initiatives and grant opportunities. She also outlined the Indian Business...

Read MoreNCN Hosts Webinar featuring CDFI Fund Representatives

On Friday, March 25, 2022, NCN hosted CDFI Fund representatives Jodie Harris and Michelle Dickens provide key updates about the CDFI Fund’s Native American CDFI Assistance (NACA) Program, the increased NACA funding for Fiscal Year 2022, the recently authorized Minority Lending Program, proposed changes to the federal certification process for...

Read MoreBreaking News: Administration Announces Plan to Address Home Valuation Bias

Vice President Kamala Harris Announces Release of Plan During White House Event with Secretary Marcia L. Fudge, White House Domestic Policy Advisor Susan Rice, and Americans Impacted by Bias in the Appraisal Process On June 1, 2021—the centennial of the Tulsa Race Massacre—President Biden announced the creation of the Interagency...

Read MoreNCN Hosts Webinar featuring Center for Indian Country Development

On Friday, March 4, 2022, NCN hosted Casey Lozar from the Center for Indian Country Development. CICD is currently working to deepen – through data – our understanding of the state and progress of tribal economies across Indian Country and how that should inform policy solutions at the tribal, federal,...

Read MoreNCN Hosts USDA Webinar Feb 24th: Building A Community Starts At Home

On Thursday, February 24th, 2022, Native CDFI Network hosted David J. Corwin, Deputy Director of Lender and Partner Activities for the USDA Rural Development Single Family Guaranteed Program, for an informational meeting. During this presentation, David discussed using the Section 502 USDA Single Family Housing Guaranteed Loan Program to help...

Read MoreNCN hosts National Community Reinvestment Coalition Webinar on January 27th

Native CDFI hosted a webinar with the National Community Reinvestment Coalition (NCRC) on January 27th. NCRC guest speakers included Juan Leyton, Director of Organizing, Greg Wilson, Senior Organizer, and Catherine Petrusz, CRA Coordinator. NCRC and its member organizations work to create opportunities for people to build wealth. They are advocates...

Read MoreWebinar Series focused on NACA FA Program hosted by NCN

On Thursday, January 6th, Native CDFI Network hosted a webinar series focused on The CDFI Fund’s Native American CDFI Technical Assistance (NACA FA) Program. With the NACA FA having numerous moving parts, this session focused on making all of the features cohesive to form a robust application as well as...

Read MoreSSBCI Programs Webinar Session 2